What to Do If a Lender Files an Incorrect UCC When a lender or secured party files an incorrect UCC ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

What to Do If a Lender Files an Incorrect UCC When a lender or secured party files an incorrect UCC ...

Common Mistakes With UCC Filings When it comes to securing a lien and protecting priority, the prope...

How UCC Filings Impact Credit Reports – Business & Personal When it comes to understanding business ...

UCC-1 vs UCC-3 Explained: What Secured Parties Need to Know If you’re involved in secured lending, a...

Do All Lenders Require UCC Filings? If you’re seeking a business loan, you may wonder: do all lender...

How UCC Filings Affect Future Financing When you borrow money to grow your business or invest in equ...

Can UCC Liens Be Removed Early? – Complete Guide If you’re asking “can UCC liens be removed early?” ...

Why Lenders File UCC Statements – Explained Clearly When a lender asks you to sign a security agreem...

How Liens Work in Small Business Lending When you’re exploring business financing, understanding how...

What is a UCC Filing and How It Affects Business Loans When you're borrowing money—especially for a ...

How to Avoid Balloon Payments in Refinancing When you’re refinancing a loan, one of the biggest fina...

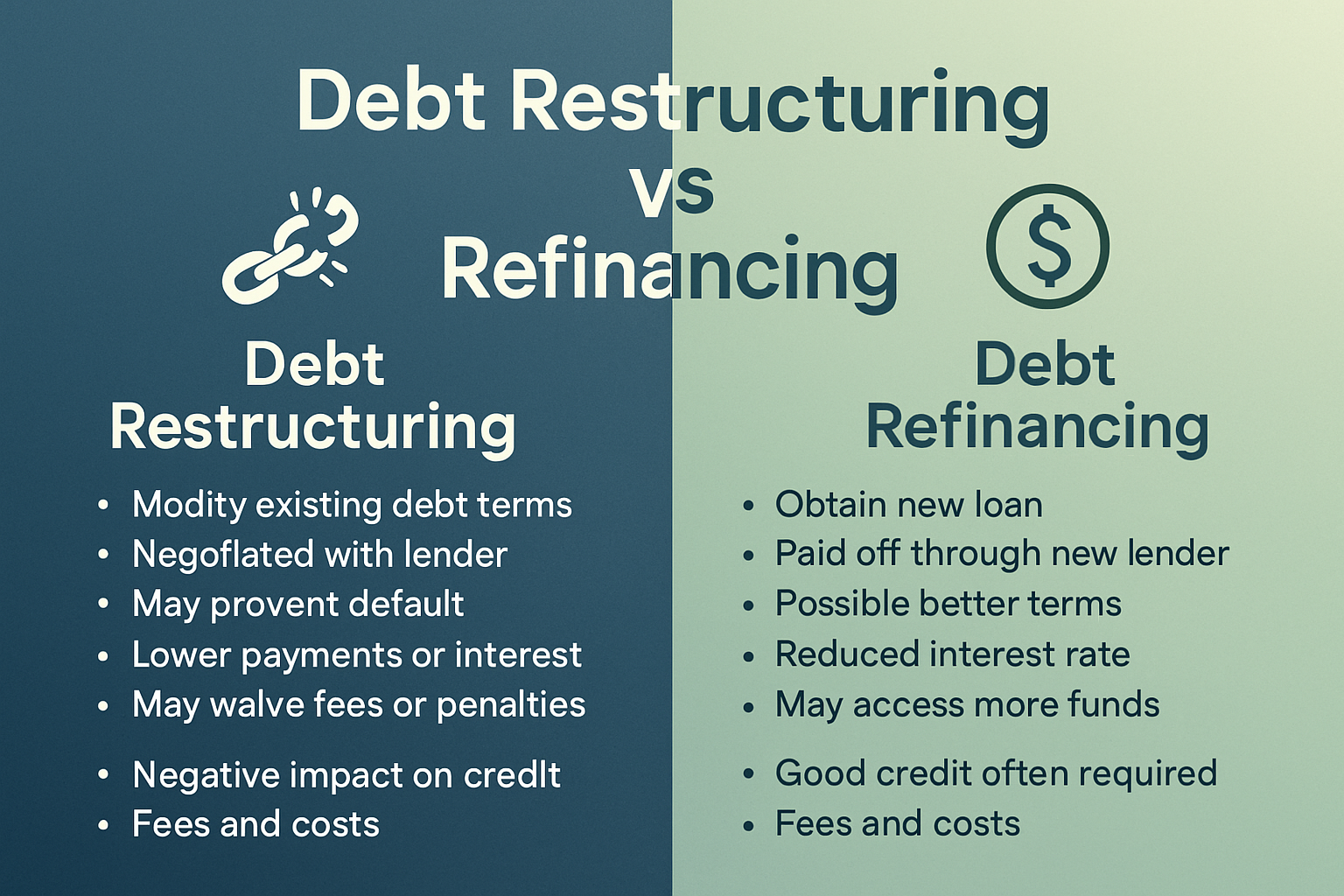

Debt Restructuring vs Refinancing: What’s the Difference? When you’re dealing with borrowed money, y...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.