Business Line of Credit: Flexible Financing for Your Small Business

- Crestmont Capital

- Small Business Lending

- Business Lines of Credit

Access working capital when you need it with a revolving business line of credit from Crestmont Capital. Draw funds, repay, and borrow again—up to your approved credit limit.

A business line of credit is a flexible financing option that gives small businesses access to funds up to a set credit limit. Unlike traditional term loans that provide a lump sum upfront, a line of credit for business lets you borrow what you need, when you need it.

Similar to a business credit card, as you repay your balance, the funds become available to borrow again. You only pay interest on the amount you actually use—making it a cost-effective solution for managing cash flow and unexpected expenses.

Draw funds when you need them for inventory, payroll, equipment, or business opportunities. Borrow only what you need, when you need it.

Interest accrues only on your outstanding balance, not your entire credit limit. This helps keep borrowing costs manageable.

As you repay, your available credit replenishes automatically. Access funds repeatedly without reapplying each time.

We provide quick approval decisions and fast access to funds—often within 24-48 hours of approval. For businesses needing immediate access, we offer solutions close to an instant business line of credit experience.

On-time payments on your line of credit can help build your business credit history, positioning you for better financing terms in the future.

Complete an application with basic business information. We evaluate your business revenue, credit score, time in business, and cash flow to determine approval. This is how to get a business line of credit with Crestmont Capital—we make the process straightforward and transparent.

If approved, you'll receive a credit limit based on your business's financial profile—typically ranging from $10,000 to $250,000 or more.

Access your line of credit when you need capital. Funds are deposited directly into your business bank account.

Pay interest on the amount borrowed with weekly or monthly payments. As you repay, your available credit is restored.

Continue borrowing and repaying throughout your draw period without needing to reapply.

Get your business credit line of credit

To qualify for a business line of credit with Crestmont Capital, we typically look for:

Time in Business: At least 6-12 months in operation

Annual Revenue: Minimum requirements start around $100,000 annual revenue

Credit Score: Generally 550+ (specific requirements depend on your overall business profile)

Business Bank Account: Active checking account with 3-6 months of statements

Additional Documentation:

For qualifying businesses, we also offer no doc business line of credit options with streamlined documentation requirements based on bank account history and revenue verification.

A secured business line of credit requires collateral such as equipment, inventory, or real estate. When you secure your line of credit, we can often offer:

Trade-off: Asset risk if unable to repay

For businesses with substantial assets, a business equity line of credit can leverage your business property or equipment to secure more favorable terms.

An unsecured business line of credit requires no collateral—we base approval on your creditworthiness. Features:

This option works well for service-based businesses or companies without significant physical assets.

Our most popular option—borrow, repay, and borrow again throughout your draw period. This flexible structure makes it one of the best business line of credit options for managing variable expenses.

Line of credit business loans offer the best of both worlds—access to capital like a term loan with the flexibility of revolving credit.

Business line of credit rates typically range from approximately 5% to 30% APR. Your specific rate depends on:

Common Fees:

The most creditworthy businesses with strong financials typically qualify for rates on the lower end of this range and can access the best business line of credit rates available.

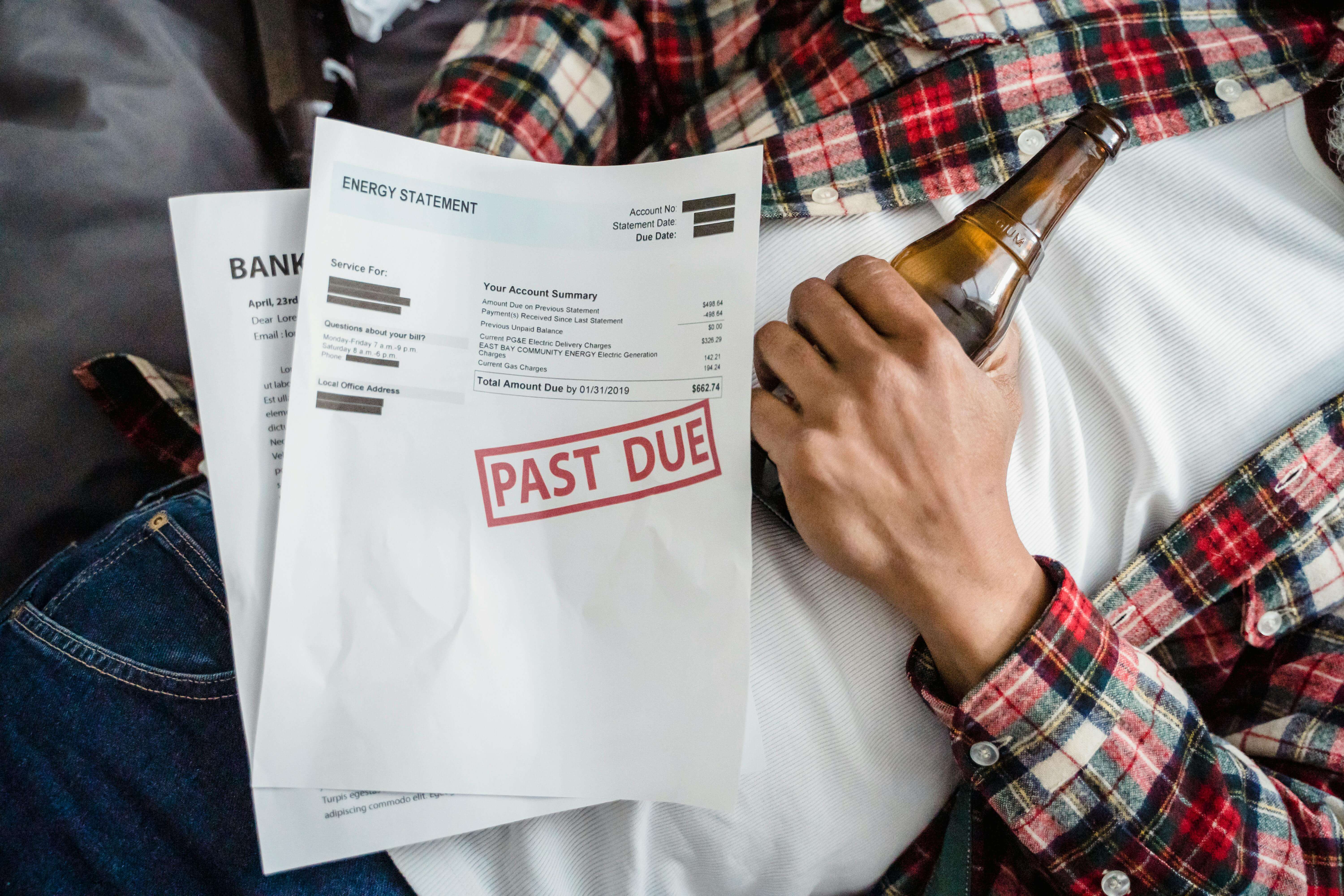

Managing Cash Flow: Bridge gaps between customer payments or seasonal revenue fluctuations

Operational Expenses: Cover supplies, payroll, or utilities during slower periods

Business Opportunities: Purchase bulk inventory, respond to time-sensitive opportunities, or fund growth initiatives

Emergency Expenses: Handle unexpected repairs or urgent replacements without disrupting operations

Multiple Projects: Fund simultaneous projects with different timelines

Speak with a financing specialist

While it's more challenging, we do work with newer businesses seeking a business line of credit for startup companies. We prefer at least 6-12 months in operation for a business line of credit for new business applicants, though startups with excellent personal credit (720+), strong revenue, or collateral may qualify.

For very new businesses, we evaluate:

Review our business line of credit requirements for time in business, revenue, and credit score.

Gather business bank statements (3-6 months), tax returns, licenses, and financial statements.

Complete our application online or speak with one of our financing specialists. We provide preliminary decisions quickly—often within hours. Apply for a business line of credit today to get started.

We'll walk you through all costs including APR, fees, repayment schedule, and any personal guarantee requirements before you accept.

Once approved, you can begin drawing on your line of credit immediately.

We pride ourselves on quick decisions. Many applications receive preliminary approval within 24 hours, with final approval and funding completed within 2-5 business days.

We offer both secured and unsecured options, including business equity line of credit solutions for businesses with collateral.

Our business line of credit rates are competitive and transparent—all costs disclosed upfront.

Since 2015, we've helped thousands of businesses access the working capital they need through line of credit business loans.

From application to funding, we make it easy to get the capital your business needs.

What credit score do I need?

We typically work with businesses that have credit scores of 625 or higher, though this is just one factor we consider. Your revenue, time in business, and overall financial profile are equally important in our evaluation.

Can startups get a business line of credit?

Yes, we offer a business line of credit for startup companies. We prefer at least 6-12 months in operation, though startups with excellent personal credit (720+), strong revenue, or collateral may qualify.

How long does approval take?

We pride ourselves on quick decisions. Many applications receive preliminary approval within 24 hours, with final approval and funding completed within 2-5 business days.

What's the difference between secured and unsecured?

A secured business line of credit requires collateral and typically offers lower rates but puts assets at risk. An unsecured business line of credit doesn't require collateral but has higher rates and stricter qualification criteria.

How much can I borrow?

We offer credit limits typically ranging from $10,000 to $250,000, with larger amounts available for highly qualified businesses.

Can I pay off early?

Yes, we allow early payoff without penalties in most cases. We'll clarify the specific terms during your application review.

Does applying affect my credit?

We perform a soft credit check initially, which doesn't affect your score. A hard inquiry may occur if you proceed with our offer.

Do I need a personal guarantee?

We typically require personal guarantees from owners with 50%+ ownership stake, depending on your business credit profile and financial strength.

Do you offer no documentation options?

For qualifying businesses with strong bank account history, we offer no doc business line of credit solutions with streamlined documentation requirements.

Calculate the true cost including all fees and interest. We're transparent about all costs upfront so you can make an informed decision.

Only draw what you need and can afford to repay. Using credit for basic operating expenses may indicate deeper business issues that should be addressed.

Be cautious of any financing provider who:

Most lines require annual or periodic renewal. We work with you to maintain your credit line by keeping strong financials and a positive payment history.

A small business line of credit with Crestmont Capital works best when you:

Before applying, assess whether this financing addresses your actual business needs or if alternatives might be more suitable.

Ready to explore a business line of credit with Crestmont Capital?

📞 Call Us: 800-949-0401

🕒 Hours: Monday-Friday, 8 AM - 6 PM ET

Apply for business line of credit now

Whether you need a secured business line of credit, an unsecured business line of credit, or a business line of credit for new business ventures, our team is ready to help you access the flexible financing your business deserves.

FINANCIAL ADVISORY DISCLOSURE: This content provides general educational information about business lines of credit and should not be construed as financial advice tailored to your specific circumstances. Lending terms, interest rates, and qualification requirements are subject to change. Before making any financial decisions, consult with a qualified financial advisor, accountant, or attorney. We strongly recommend reading all documents carefully and ensuring any financing aligns with your business capacity to repay.

Note: Information current as of November 2025. Interest rates and lending criteria are subject to change.