Small Business Grants vs. Loans: Which Is Better in 2025? Choosing how to fund your small business i...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Small Business Grants vs. Loans: Which Is Better in 2025? Choosing how to fund your small business i...

SBA Express Loan Guide: Fast Funding for Small Businesses If you need small business financing quick...

Equipment Financing vs. Equipment Leasing: Which Saves More Money? When your business needs new equi...

How to Choose the Right Business Loan Term Length Choosing the right business loan term length can m...

Small Business Loans for Women Entrepreneurs in 2025 Women entrepreneurs face unique challenges acce...

Best Short-Term Business Loan Options in 2025 Rising interest costs, high monthly payments, or outda...

How to Refinance a Business Loan in 2025 for Lower Rates Rising interest costs, high monthly payment...

SBA Loan vs. Online Business Loan: Which Is Right for You? When you’re looking for financing to grow...

Business Loan Approval Secrets Banks Don’t Tell You If you’ve ever applied for a business loan and b...

How to Use Loans to Scale Your Small Business Fast Scaling a small business takes more than ambition...

Best Equipment Leasing Companies for Small Businesses in 2025 Why Choose Equipment Leasing Over Buyi...

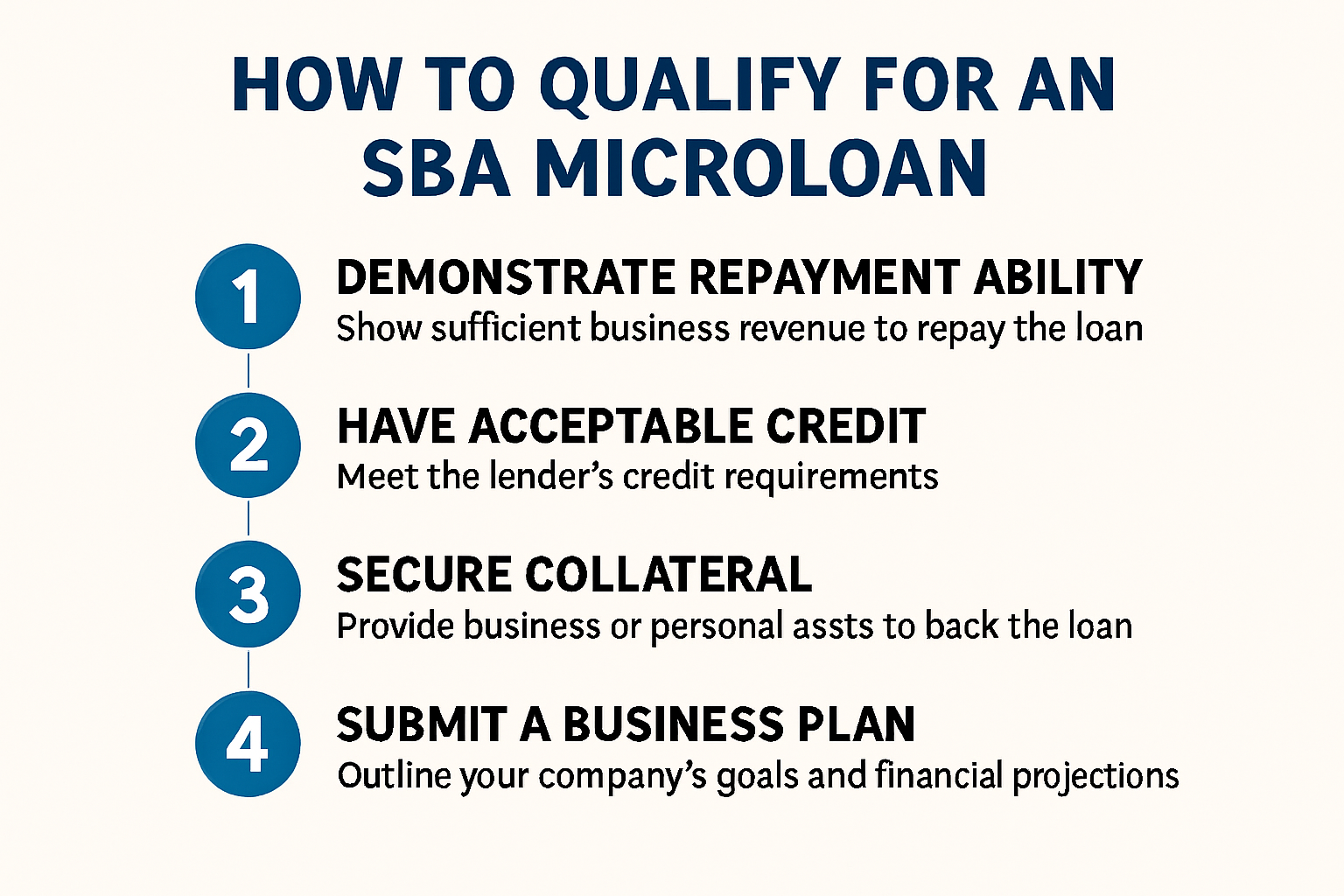

How to Qualify for an SBA Microloan: Step-by-Step Guide If you’re a small business owner or startup ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.