Best Bad Credit Business Loan Lenders in 2025 If you have bad credit (or a challenged credit history...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Best Bad Credit Business Loan Lenders in 2025 If you have bad credit (or a challenged credit history...

Merchant Cash Advance Alternatives: Smarter Funding Options f you’re a small business owner without ...

How to Get a Business Loan With Only Bank Statements If you’re a small business owner without years ...

What Documents Are Required for a Business Loan in 2025? Applying for a business loan can be a game ...

SBA 7(a) Loan Guide: Benefits, Requirements, and Rates The SBA 7(a) loan program is one of the most ...

How to Build Business Credit Fast for Better Loan Terms Strong business credit is one of the most va...

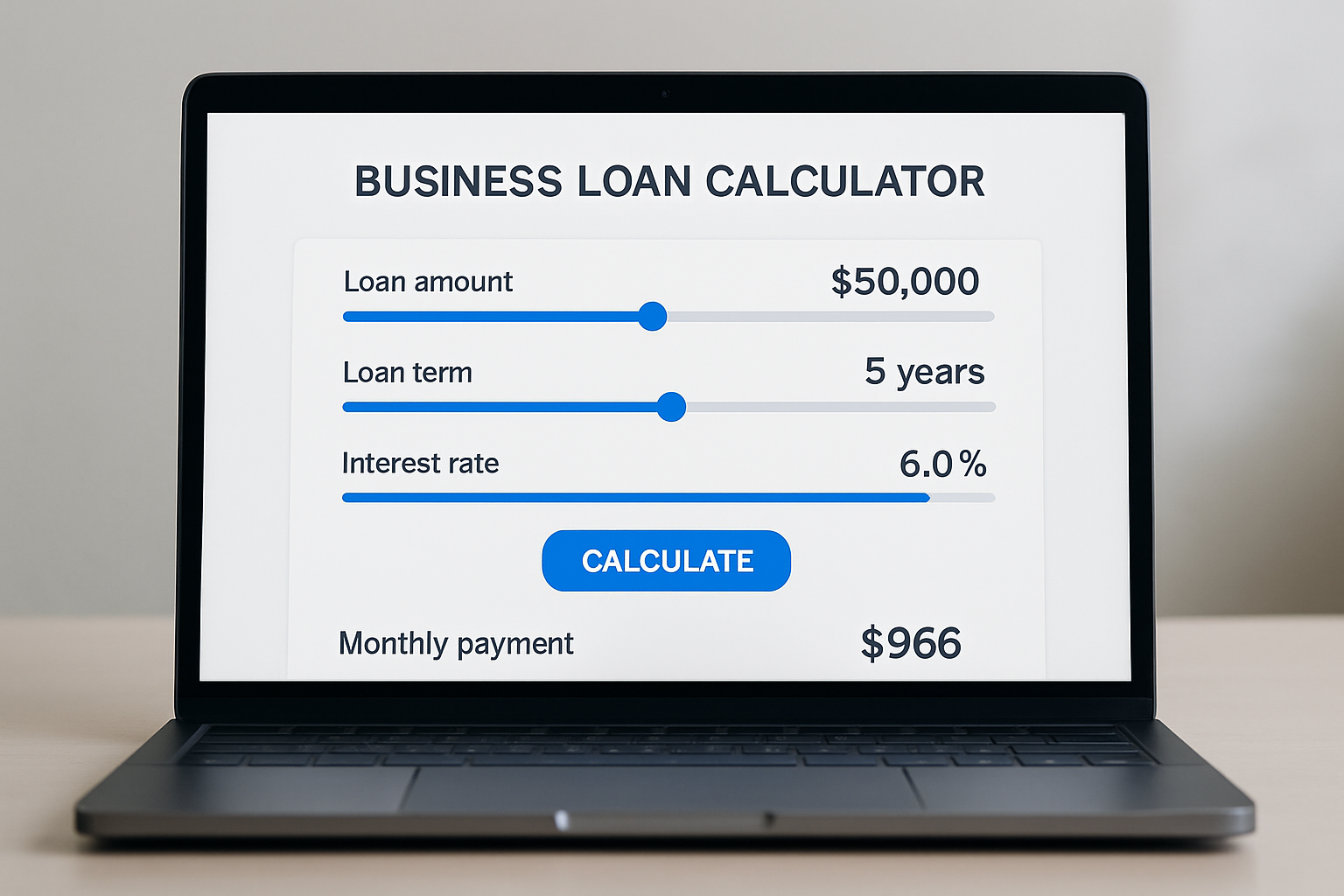

Business Loan Calculator: Estimate Payments Before You Apply Before applying for a loan, it’s crucia...

How to Get a Business Loan Without Collateral in 2025 Many small business owners assume they need pr...

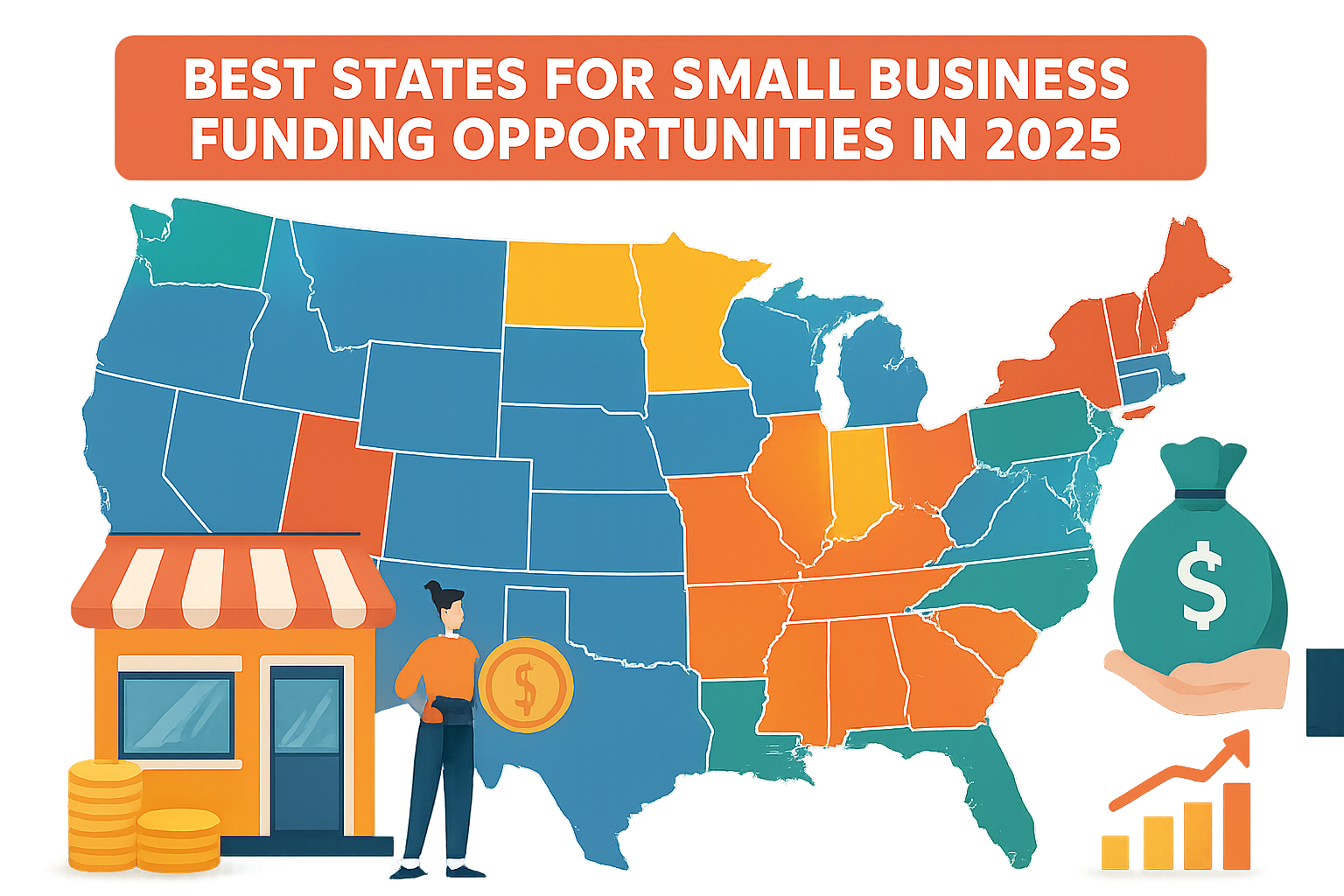

Best States for Small Business Funding Opportunities in 2025 In 2025, where your business is located...

Business Loan Application Checklist for Faster Approval Applying for a business loan can be intimida...

Best Business Loans for Startups With No Revenue Why It’s Hard to Get a Loan With No Revenue Lenders...

How to Use a Business Loan to Increase Cash Flow Cash flow is the lifeblood of any business. Without...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.