Equipment Financing for Medical Labs Running a medical laboratory requires constant investment in ad...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Equipment Financing for Medical Labs Running a medical laboratory requires constant investment in ad...

How SBA Loans Help With Business Acquisitions Buying an existing business can be one of the fastest ...

SBA Loan Success Stories from Small Businesses Every thriving small business has a story — one built...

What Businesses Are Most Likely to Qualify for SBA Loans Getting approved for an SBA loan is one of ...

How to Choose Between SBA and Traditional Loans Choosing the right business loan can make or break y...

How to Speed Up SBA Loan Approval Applying for an SBA loan is one of the smartest ways to secure aff...

How to Speed Up SBA Loan Approval Applying for an SBA loan is one of the smartest ways to secure aff...

What Documents Are Required for SBA Loans Applying for an SBA loan can be one of the smartest financ...

Why SBA Loans Are Popular With Small Businesses When small businesses look for affordable, reliable ...

SBA Express Loans Explained If you need fast business funding but still want the benefits of an SBA-...

How SBA Disaster Loans Work When natural disasters, wildfires, floods, or unexpected crises strike, ...

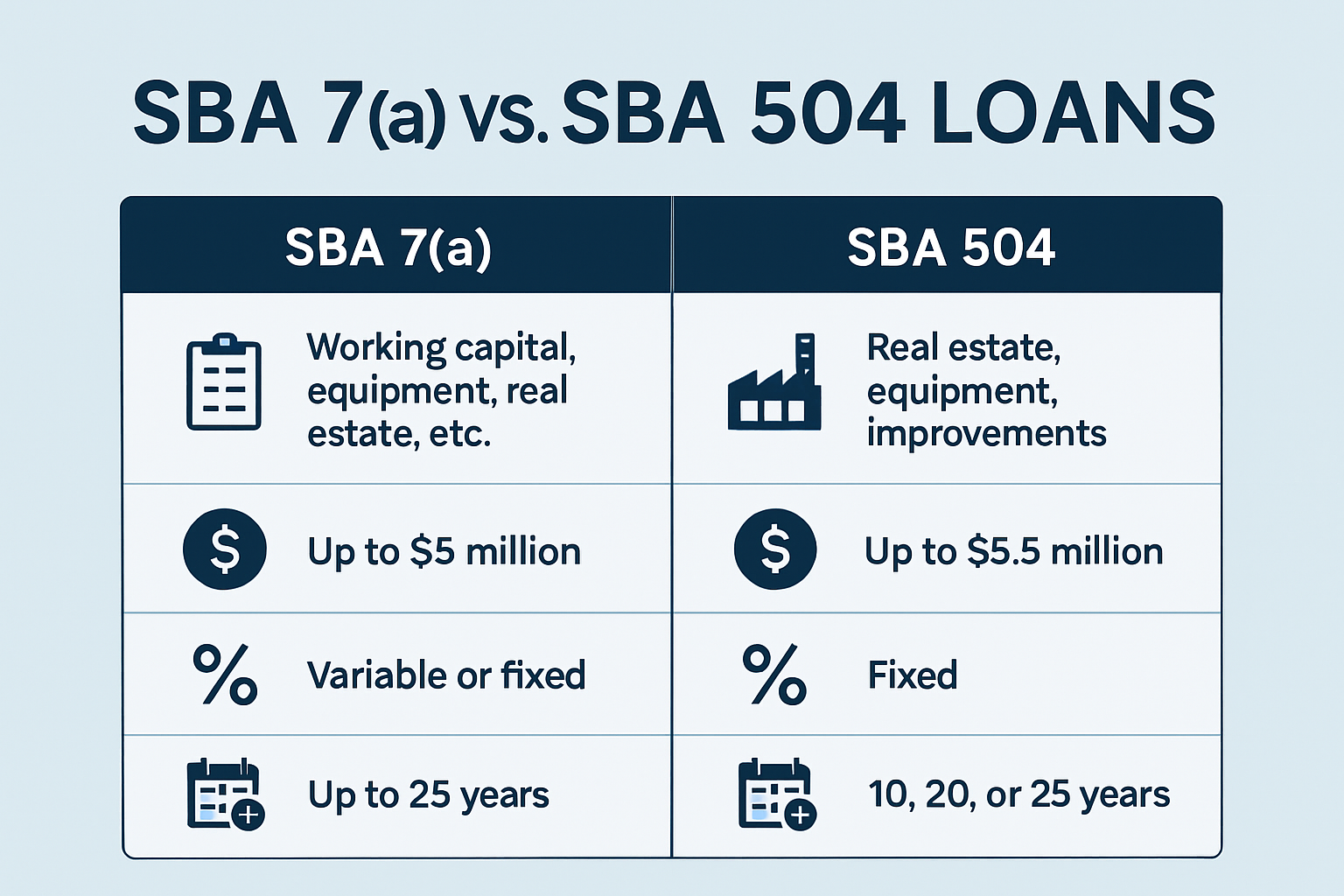

Differences between SBA 7(a) and SBA 504 loans If you’re exploring small business financing through ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.