How to Get a Business Loan Without Tax Returns in 2026 Getting approved for a small business loan is...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How to Get a Business Loan Without Tax Returns in 2026 Getting approved for a small business loan is...

SBA Loans in 2025: What’s New and What’s Changed In 2025, SBA (Small Business Administration) loan p...

Business Loan Success Stories: Real Examples of Growth Every business owner dreams of growth — openi...

How to Use Business Loans for Hiring and Staffing As your business grows, so does the need for more ...

Best Working Capital Loan Providers in 2025 Running a nonprofit doesn’t mean you don’t need funding....

Small Business Loans for Nonprofits: What Are the Options? Running a nonprofit doesn’t mean you don’...

How to Finance Business Operations With Invoice Factoring When cash flow slows down, even profitable...

Best Business Loans for Startups With Low Credit Scores Starting a business is challenging enough — ...

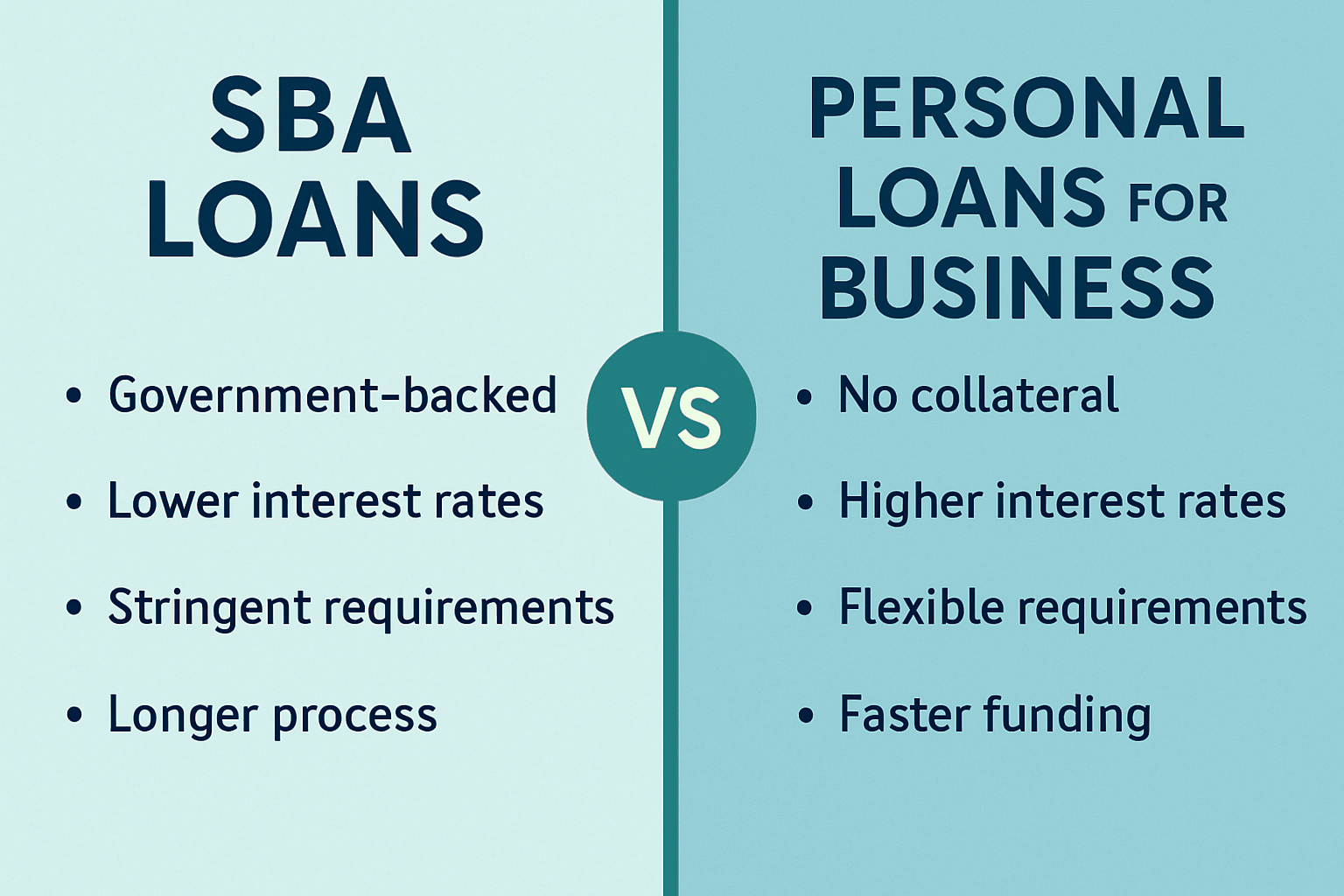

SBA Loans vs. Personal Loans for Business: Which Is Smarter? When you’re ready to fund your small bu...

How to Finance Large Equipment Purchases for Small Businesses Buying large equipment is one of the b...

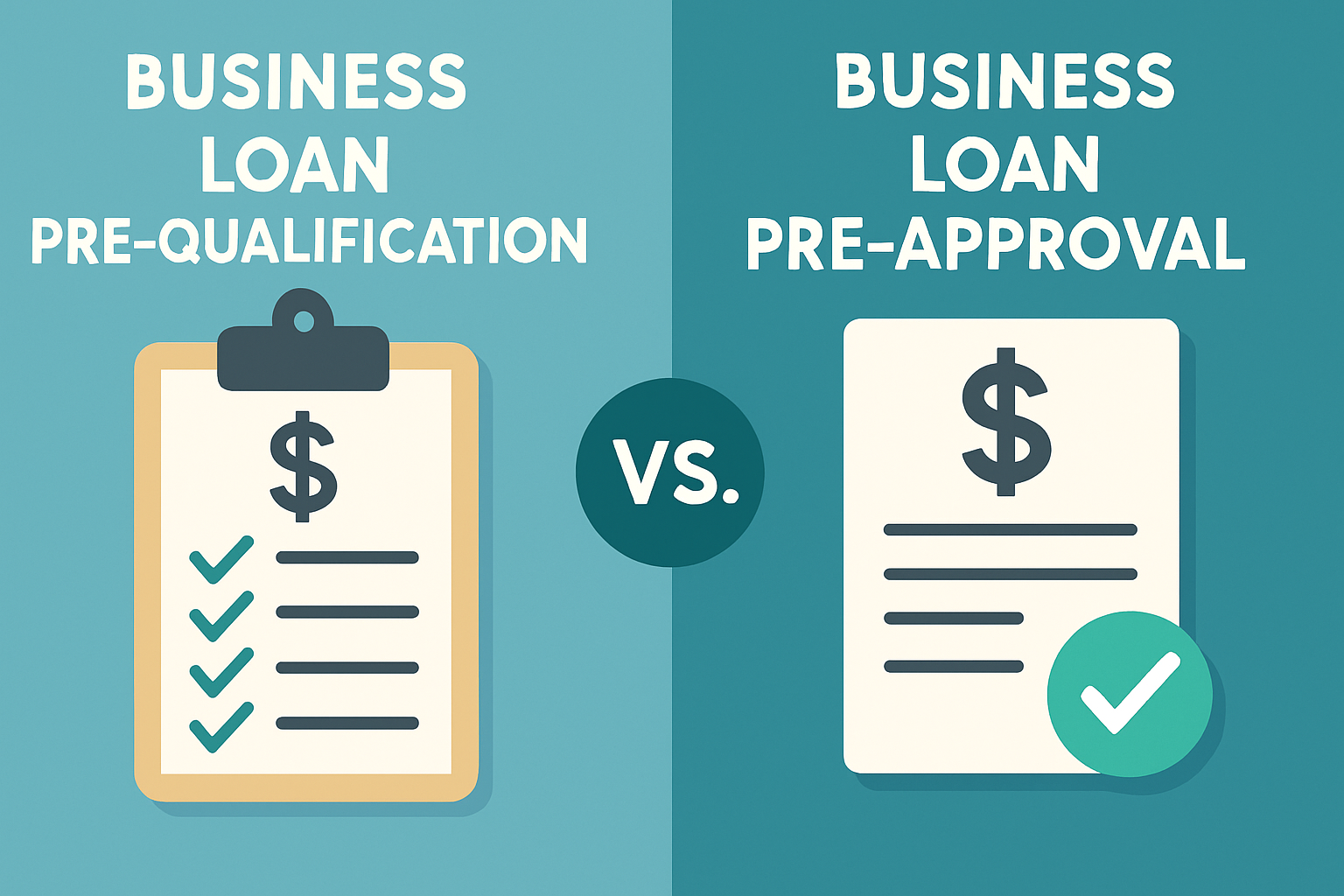

Business Loan Pre-Qualification vs. Pre-Approval: What’s the Difference? When you’re looking for a s...

How to Finance a Business During a Recession Economic downturns can be tough on small businesses — s...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.