What’s the Difference Between Mezzanine Financing and a Loan

In the world of business funding, understanding what’s the difference between mezzanine financing and a loan is vital for making strategic decisions. Both offer ways to raise capital, but they serve different purposes, carry different risks, and impact your business in distinct ways. This article dives deep into those differences, so you can assess which path makes sense.

Understanding the Basics: What is a Loan?

Definition of a Loan

A loan is essentially money or another asset provided by a lender to a borrower, who agrees to repay the principal amount plus interest over time.

Key elements include:

-

Principal: the amount borrowed.

-

Interest rate: the cost of borrowing.

-

Term or maturity: how long you have to repay.

-

Collateral (sometimes): an asset pledged to secure repayment.

Types of Loans

Loans come in many varieties:

-

Fixed-term or amortized vs revolving credit or lines of credit.

-

Business loans, personal loans, mortgages, etc.

Typical Features of Loans

-

For conventional bank business loans, lenders often use asset values, cash flow, credit history as the basis of approval.

-

Interest rates tend to be lower when the loan is secured and the borrower has strong credit.

-

The lender expects regular repayments of both principal and interest (unless interest-only or balloon payment structures apply).

Understanding Mezzanine Financing

Definition of Mezzanine Financing

Mezzanine financing (also called mezzanine debt) is a hybrid funding instrument that blends features of debt and equity. It usually sits between senior debt (bank loans) and equity in the capital structure.

For example:

-

Subordinated debt (junior to senior loans).

-

May carry warrants or conversion rights into equity.

-

Often unsecured or with weaker collateral compared to senior debt.

Why Businesses Use Mezzanine Financing

Businesses turn to mezzanine when they:

-

Want growth, acquisitions, buyouts, recapitalisation without giving up too much equity.

-

Want flexible terms (e.g., interest-only, deferred payments) that allow time for the business to grow.

Key Characteristics of Mezzanine Financing

-

Subordination: It is behind senior debt in the pecking order.

-

Higher cost: Given the higher risk, interest rates or expected returns are higher.

-

Equity kicker: Lender may have a warrant or conversion right to share in upside.

-

Flexible structure: Terms may allow interest-only payments, deferred payments, balloon at end.

-

Preserves ownership: Compared to issuing equity, existing shareholders often retain control while gaining capital.

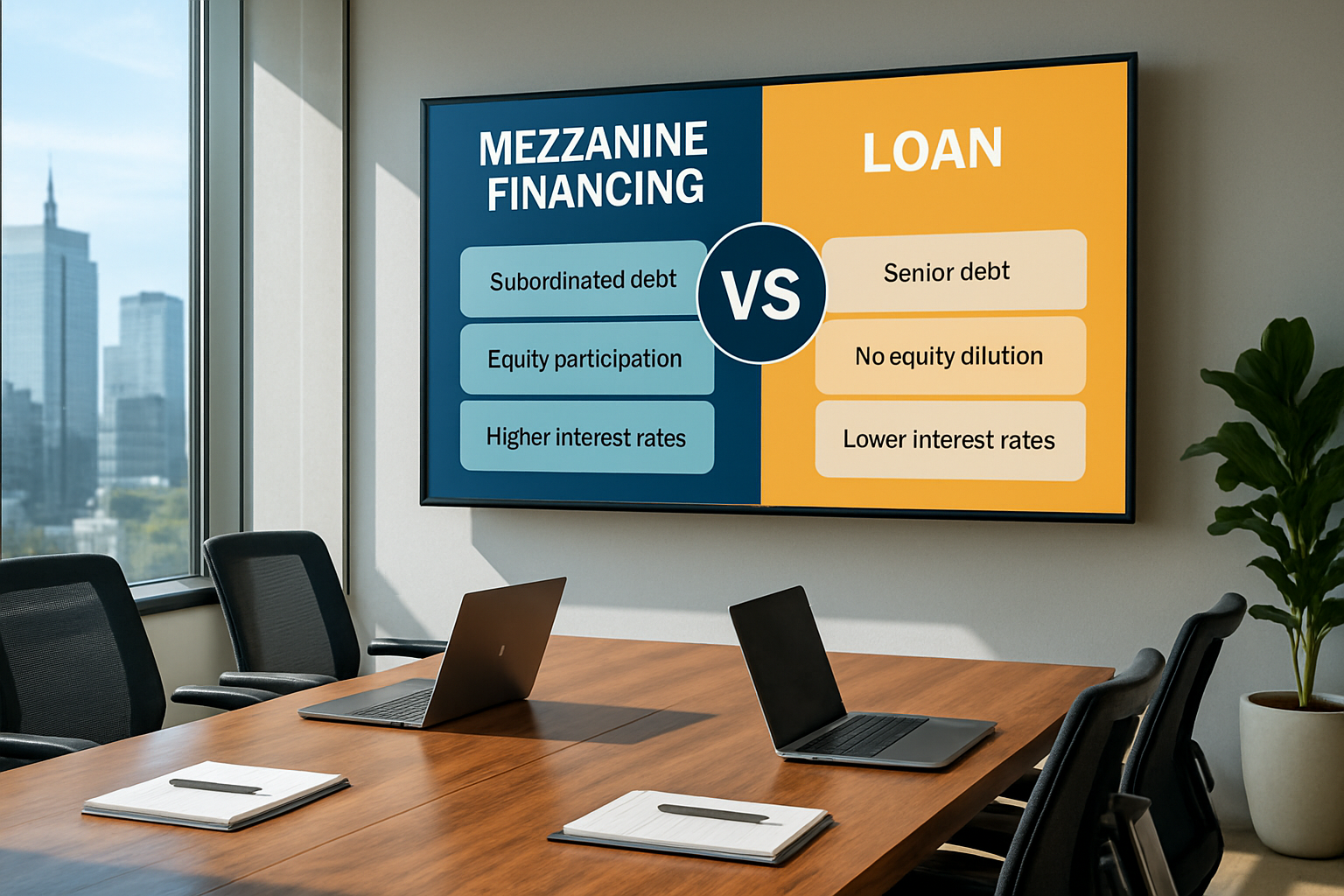

Side-by-Side: Mezzanine Financing vs a Standard Loan

Let’s compare both across multiple dimensions so you can clearly see what’s the difference between mezzanine financing and a loan.

Which is Safer?

From the lender’s perspective: a conventional loan is safer because of collateral, higher repayment priority. From the borrower’s perspective: a conventional loan is simpler, lower cost, fewer equity implications.

Mezzanine financing is riskier (and costlier) but gives you more capital leeway and ownership flexibility.

Which is Cheaper?

Conventional loans typically have lower interest rates than mezzanine financing. Because mezzanine lenders assume more risk and demand upside, cost is higher.

Therefore, if you can secure a standard loan at favourable terms, it is usually the cheaper capital option.

Ownership Implications

A standard loan typically doesn’t affect ownership: you borrow, repay, maintain control.

Mezzanine, however, may include equity participation or warrants, which may dilute ownership or give lenders board rights or control clauses.

Flexibility and Fit

Loans are more appropriate when you have collateral, stable cash flow, predictable repayment.

Mezzanine works better when you need additional capital beyond senior debt limits, want to drive growth/acquisition, but still maintain ownership — even at higher cost.

How to Decide Which Option to Use

Key Questions to Ask

-

What is your current debt capacity? Have you reached senior debt limits?

-

What is your cash-flow stability? Can you service regular loan repayments?

-

Do you have collateral to support a conventional loan?

-

Do you want to preserve ownership and control or are you comfortable with dilution?

-

What time-horizon and purpose for funding? Growth, acquisition, refinancing?

-

How sensitive are you to cost of capital? Can you afford higher cost of mezzanine?

When a Loan Makes More Sense

-

Well-established business with good credit, collateral, stable cash flows.

-

You want lower cost and limited complexity.

-

The purpose is relatively low risk and well defined (e.g., equipment purchase).

When Mezzanine Financing Makes More Sense

-

You’ve maxed out senior debt or lenders won’t extend further.

-

You’re undertaking aggressive growth, acquisition, or recapitalisation.

-

You want to avoid giving up too much equity but are comfortable with higher cost and complex terms.

-

You want flexibility: interest-only payments, delayed amortisation, weaker collateral.

Real-World Examples & Practical Considerations

Example of a Standard Loan

Suppose Company A wants $2 million to buy new manufacturing equipment. It has strong cash flow and a lienable asset. A bank term loan at 6% interest, amortised over 7 years, secured by the equipment and perhaps a corporate guarantee—typical conventional loan scenario.

Example of Mezzanine Financing

Company B wants to acquire a competitor for $10 million. The bank will provide $6 m senior debt but the remaining $4 m needs to come from another source. A mezzanine fund provides $4 m subordinated debt, at say 12–20% interest plus a warrant for equity. If Company B’s acquisition succeeds, the mezzanine lender may share in upside.

What to Watch Out For

For loans:

-

Collateral requirements.

-

Covenants (financial ratios, restrictions).

-

Rigid schedules.

-

Missed payments risk default.

For mezzanine financing:

-

Higher interest and overall cost.

-

Potential equity dilution or lender control rights.

-

Subordinate repayment – risk is higher.

-

Documentation complexity: conversion rights, warrants, PIK (payment in kind) interest.

Impact on your Balance Sheet & Capital Structure

Mezzanine debt may sometimes be treated more like equity from an accounting perspective (since it’s subordinated, interest-only, etc) which can help companies preserve senior debt capacity.

When selecting financing, consider how the structure impacts your leverage ratio, repayment flexibility, and future ability to raise funds.

Common Misconceptions

Misconception 1: “Mezzanine financing is just another loan.”

Not quite. While it is debt in form, mezzanine features equity-like elements and sits differently in the capital structure. Much higher risk and cost.

Misconception 2: “Loans always have collateral, mezzanine never does.”

While loans are typically secured, unsecured loans exist. Similarly, mezzanine may sometimes have limited collateral or pledge of ownership interest. The key difference is subordination and cost, not always collateral.

Misconception 3: “Mezzanine always means ownership dilution.”

Not always. Some mezzanine structures may have few or no conversion rights. But typically they include some equity kicker or warrant because lenders expect upside for the higher risk.

Misconception 4: “Since mezzanine is more expensive, a standard loan is always better.”

Not always. If you’ve reached senior debt limits or cannot secure a lower cost loan, mezzanine may be the only way to bridge capital needs, especially for growth or acquisition. Cost must be weighed against opportunity.

FAQs — Direct Answers to Common Questions

Q: Which is riskier for the borrower — a loan or mezzanine financing?

-

Loans tend to be less risky in terms of cost and structure.

-

Mezzanine is riskier because of higher interest, subordinate claim, and potential equity kickers.

Q: Can a business use both a conventional loan and mezzanine financing?

Yes, and often they do: the senior loan covers the base, mezzanine fills the gap between loan and equity. For example: bank up to 60 %, then mezzanine up to another 20–30 %.

Q: Does mezzanine financing always lead to ownership loss?

Not necessarily “loss” but dilution is possible. If there are conversion rights, warrants or board control provisions, you may share ownership or oversight. Evaluate terms.

Q: Are amortisation and repayment terms different?

Yes. Loans often amortise principal + interest over the term. Mezzanine may be interest-only or deferred principal, with large balloon payment at end.

Q: Which should I aim for if I’m a small business owner seeking growth capital?

If your business has strong collateral, stable cash flow, go for a standard loan. If you’re doing a major growth move, acquisition, and have limited senior debt capacity, mezzanine may make sense — but ensure you understand cost and risks.

Key Take-aways: What’s the Difference Between Mezzanine Financing and a Loan?

-

A loan is standard debt: priority repayment, lower cost, maybe collateral, amortised principal.

-

Mezzanine financing is a hybrid: sits behind senior loans in repayment priority, higher cost, may include equity rights, more flexible but riskier.

-

Use a loan when you have conventional lending capacity, collateral, and stable cash flow.

-

Use mezzanine when you’ve exhausted traditional debt options, want growth or acquisition, and are willing to pay higher cost for flexibility and capital.

-

Always weigh cost of capital, ownership implications, repayment structure, and capital stack position before choosing.

Actionable Steps for Your Business

-

Conduct a capital stack review: determine how much senior debt you have, your equity, and what gap remains.

-

Assess your cash flow projections: can you support regular repayments of a traditional loan?

-

Evaluate ownership objectives: do you want to preserve full control or are you open to shared upside?

-

Request term sheets: compare standard loan vs mezzanine options side by side (interest rate, fees, covenants, amortisation, conversion/warrant terms).

-

Run scenario analysis: what happens if growth is slower than expected? Can you still service a mezzanine structure?

-

Seek expert advice from financial/legal professionals familiar with mezzanine structures and loan documentation.

-

Document clearly how each structure affects your balance sheet, control, risk, and future financing ability.

Summary

In summary, when exploring what’s the difference between mezzanine financing and a loan, it boils down to priority, cost, structure, and ownership impact. A conventional loan offers lower cost and higher repayment priority, but also less flexibility when your banking capacity is limited. Mezzanine financing offers a vital alternative when you need additional capital, but involves higher cost and potentially sharing ownership or control.

Understanding these differences empowers you as a business owner, CFO, or investor to choose the right financing route for your growth strategy.

Remember: the best financing is not just the cheapest — it’s the one that aligns with your cash flow profile, control preferences, and strategic goals.