When starting your business one of the biggest questions to ask yourself is when you will break even...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

When starting your business one of the biggest questions to ask yourself is when you will break even...

Business financing is the activity of funding for a business whether it is just starting or is expan...

Most lenders prefer you have collateral to help secure a business loan, but if you do not have one y...

If you are behind on your credit card payments, you might find that you have a charge-off. Having a ...

Calculating your start up costs is essential when you are just starting out with your business. Calc...

.jpg)

The cost of your small business loan depends on various factors which include the type of loan and w...

Buying a hotel or motel can become a lucrative business. Before you take the big step, you need to w...

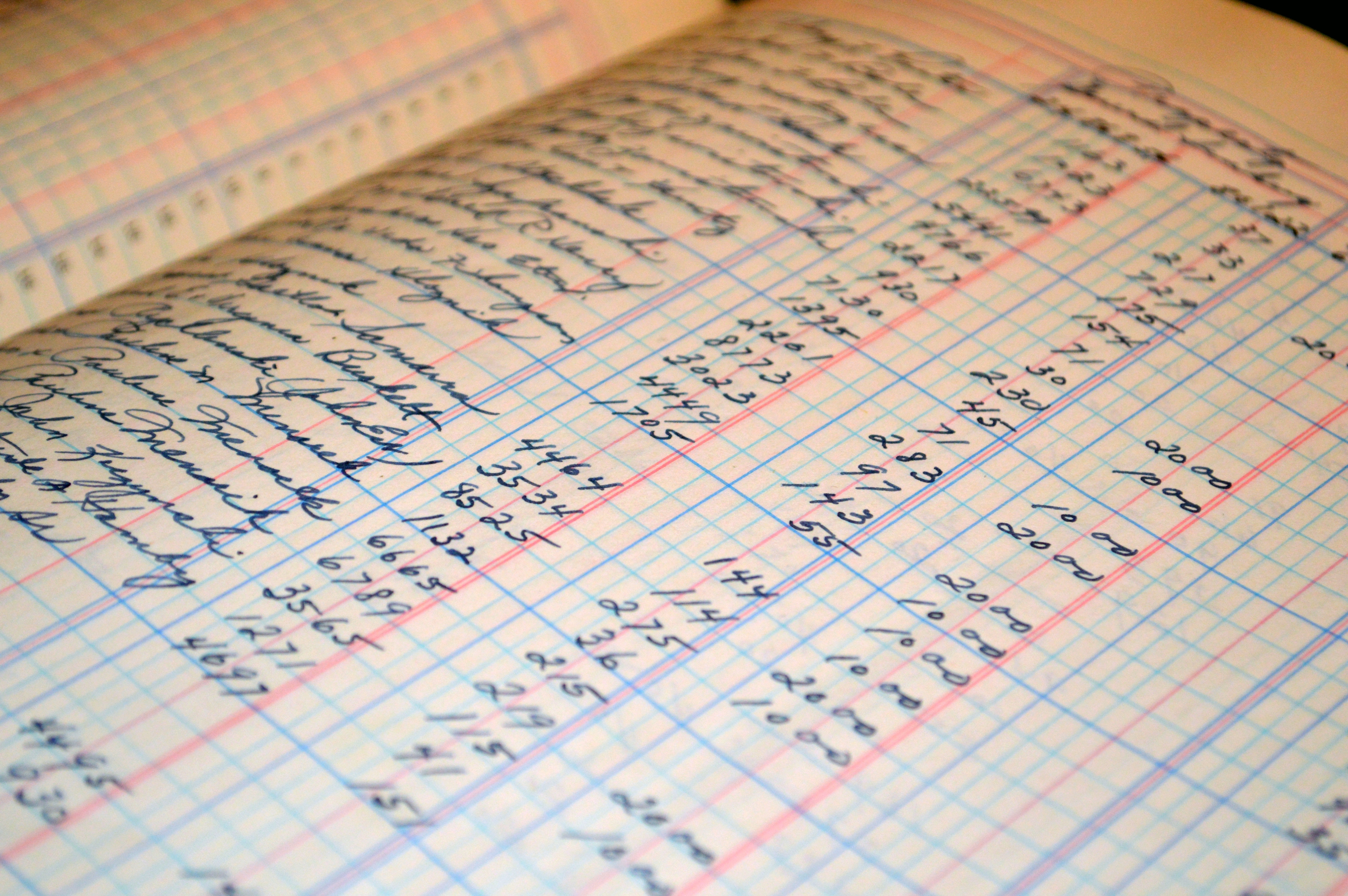

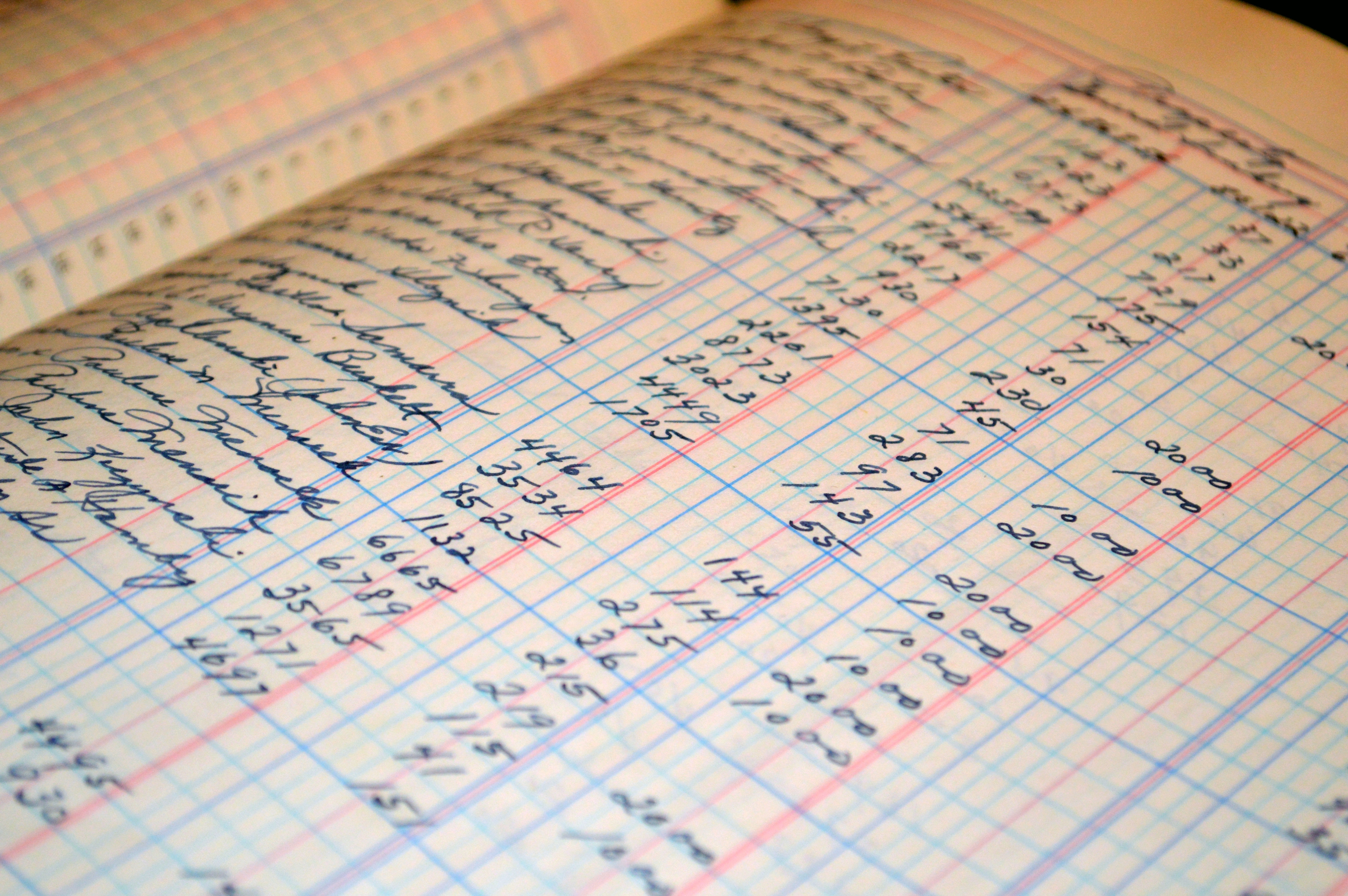

Bank statements contain a lot of useful information for lenders. Lenders want to see your bank state...

Many small business owners decide to take out loans to help grow their business and it can be a wise...

Social media is a powerful marketing tool for any business. If your business is not on any social me...

If your small business needs financing, applying for a personal loan is a common approach used by ma...

Do you have unpaid customer invoices but need financing to help run your business? Consider looking ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.