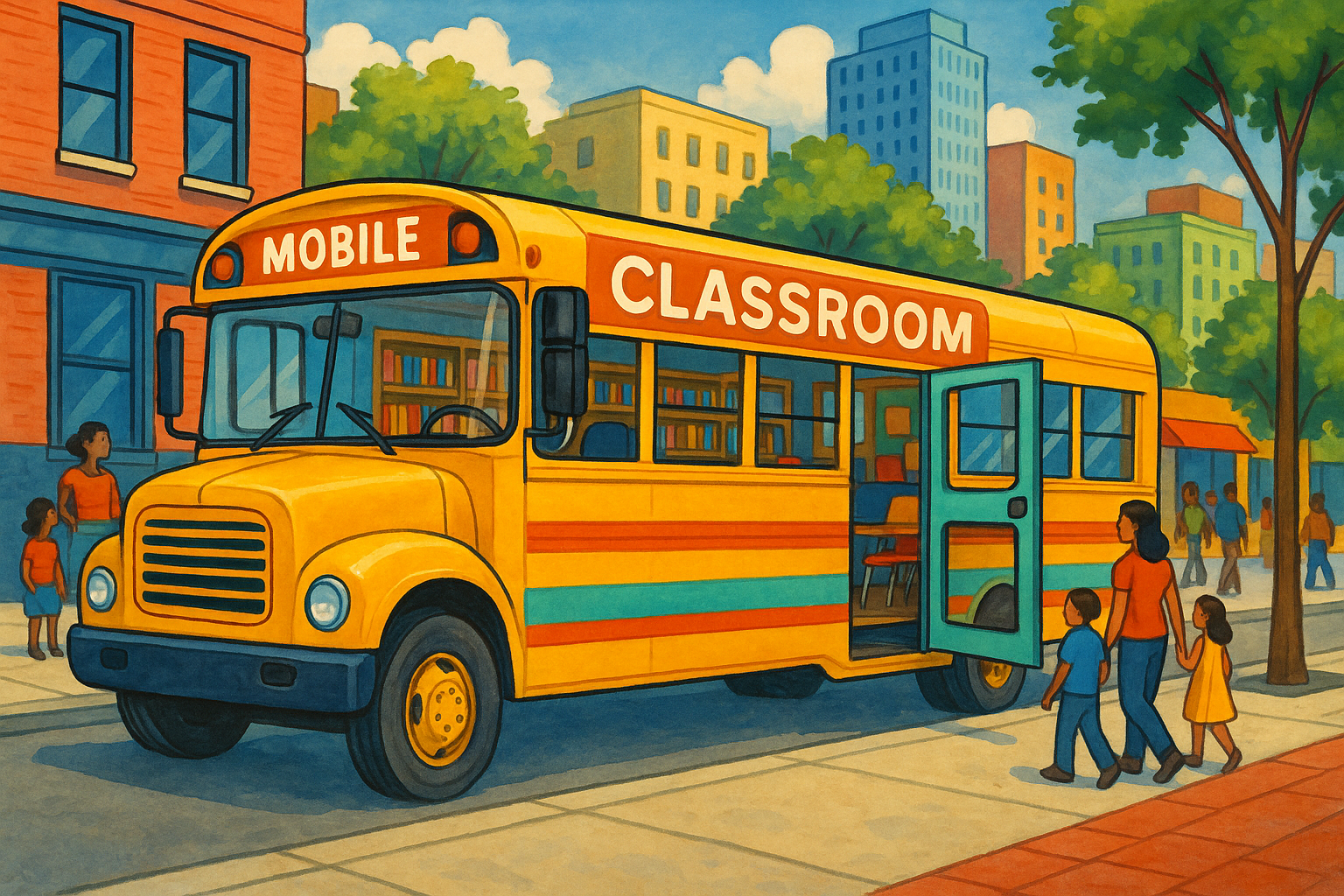

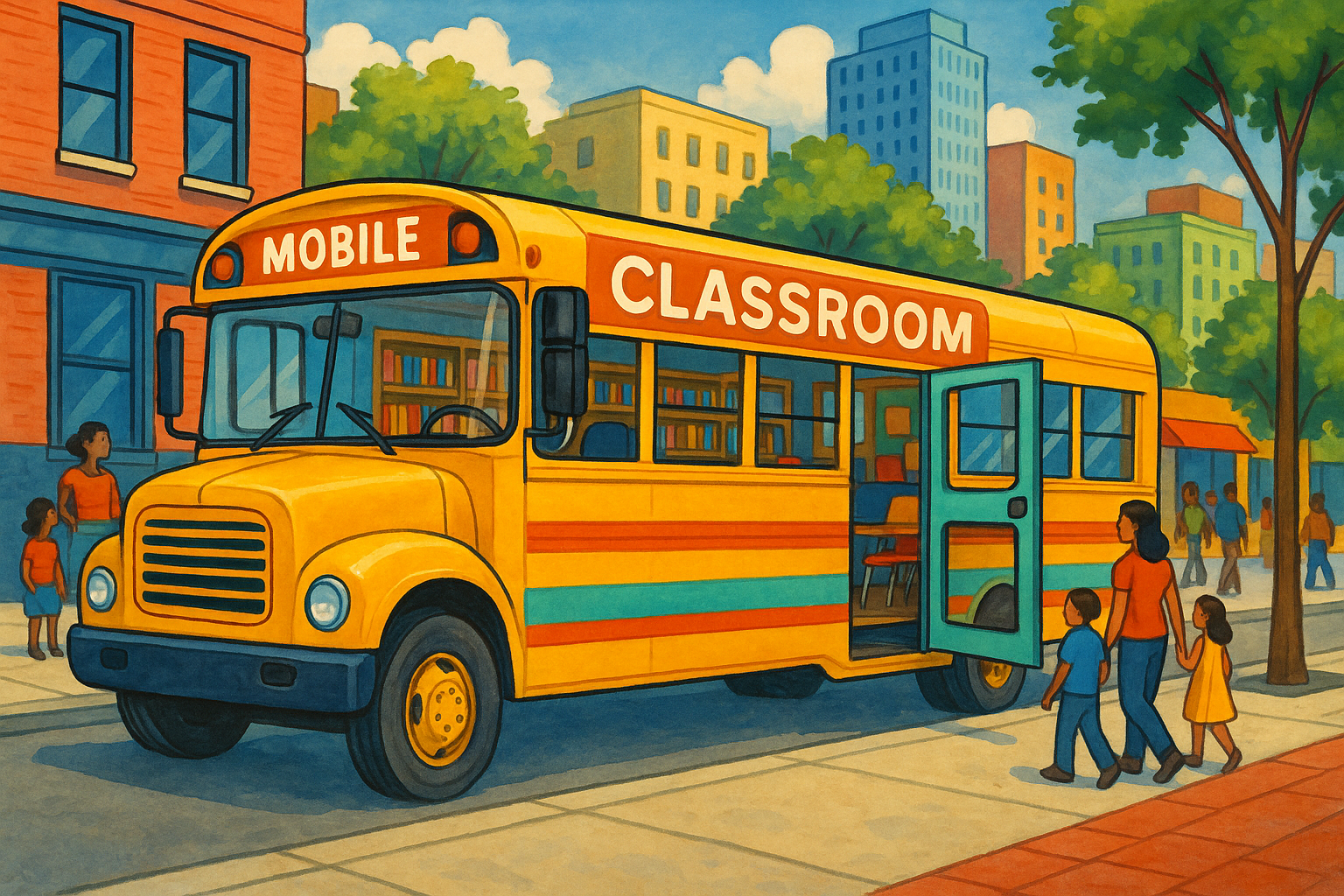

Funding a Mobile STEM Education Business STEM (Science, Technology, Engineering, and Math) programs ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

Funding a Mobile STEM Education Business STEM (Science, Technology, Engineering, and Math) programs ...

Equipment Loans for Starting a Tutoring Center Starting a tutoring center is an exciting opportunity...

Leasing Laptops and Tablets for Private Schools Technology in education is no longer optional—it’s e...

How to Finance Smartboards and Classroom Tech Modern classrooms rely on interactive smartboards, tab...

Leasing LED Window Displays and Digital Advertising Screens Retailers, restaurants, and service busi...

Equipment Loans for Opening a Mall Kiosk Business Mall kiosks are one of the most affordable and pro...

Financing POS Terminals and Kiosks in Retail Chains In today’s competitive retail environment, point...

How to Lease Display Refrigerators & Coolers for Food Franchises In the food service industry, displ...

Funding a Retail Franchise Buildout: Equipment Checklist Opening a retail franchise is an exciting o...

Leasing Portable AC Units and Dehumidifiers for Rentals Event companies, disaster relief providers, ...

How to Fund a Fleet of Service Vans for HVAC Technicians For HVAC companies, service vans are more t...

Plumbing Equipment Loans for Video Inspection and Jetting Tools For plumbing companies, having the r...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.