What Small Businesses Can Do During Recessions — Essential Recession Planning Strategy When a downtu...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

What Small Businesses Can Do During Recessions — Essential Recession Planning Strategy When a downtu...

How Interest Rate Hikes Change Business Loan Payments When interest rates increase, how interest rat...

How Inflation Affects Small Business Loan Demand | Key Insights for Borrowers In an environment of r...

Will Traditional Banks Lose Ground to Online Lenders? When we ask “Will traditional banks lose groun...

.jpg)

How AI Is Changing Underwriting for Loans – Transforming Loan Approvals and Risk In today’s fast-evo...

Why Alternative Lenders Are Faster Than Banks: Speed Matters in Financing When you’re running a busi...

Why Banks Deny Most Small Business Loan Applications – Key Reasons & Fixes When you apply for a busi...

The Role of Fintech in Small Business Loans: How Digital Lending Is Changing Access to Capital When ...

Why Alternative Lenders Are Gaining Market Share Why alternative lenders are gaining market share in...

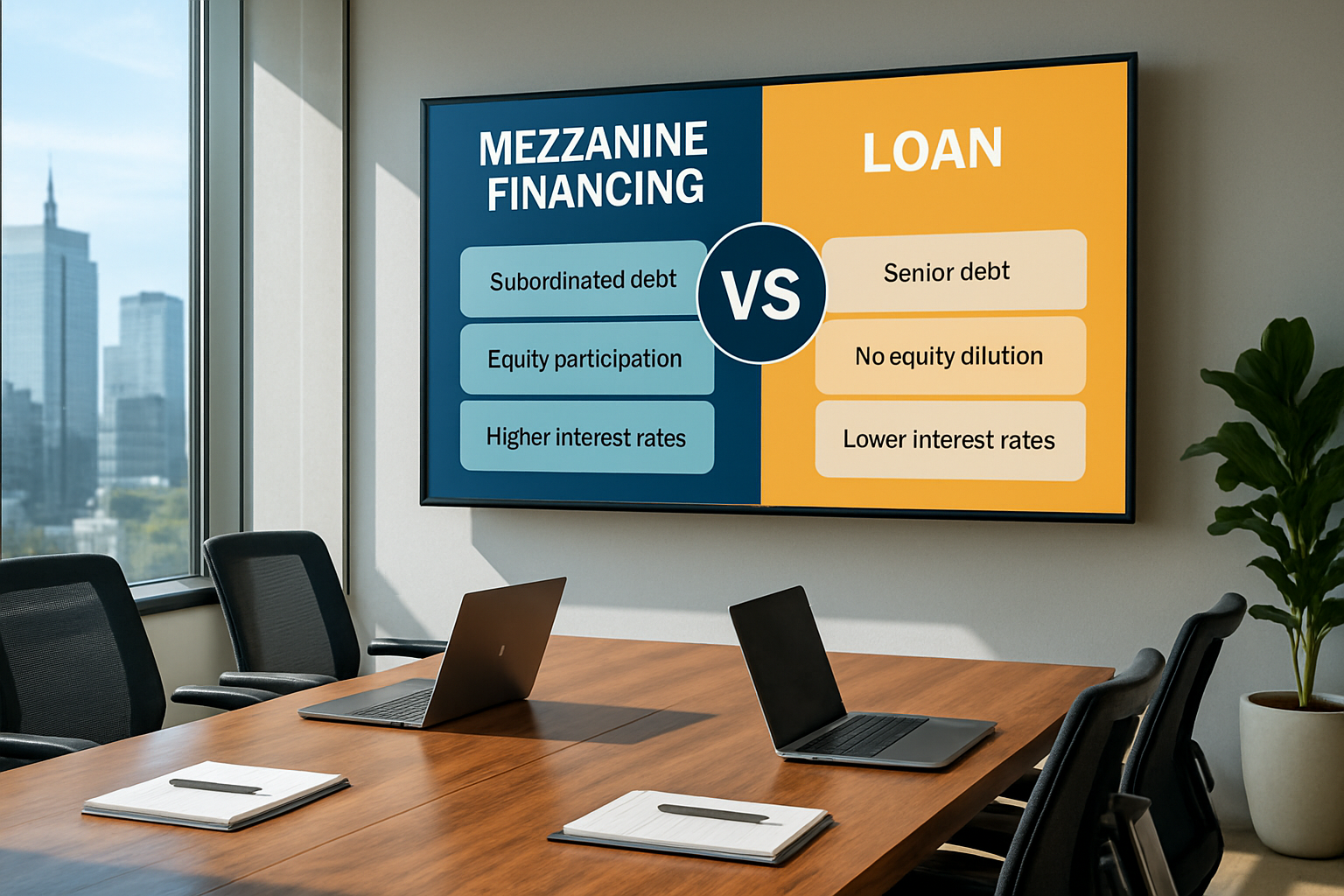

What’s the Difference Between Mezzanine Financing and a Loan In the world of business funding, under...

When to Use Friends and Family Funding vs Loans Deciding between friends and family funding vs loans...

Is Equity Financing Better Than Debt Financing? Understanding Which Works for Your Business When you...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.