Why Lenders Want to See Balance Sheets

When you apply for business financing, one of the first documents your lender will ask for is a balance sheet. But why do lenders want to see balance sheets? It’s not just a formality — it’s a key tool that helps lenders assess risk, repayment ability, and the overall health of your business.

In this post, we’ll explore:

-

What a balance sheet is, and how it’s used in lending

-

Why it matters for lenders (and therefore for you)

-

What they look for (including the key ratios)

-

How you can prepare your balance sheet to give lenders confidence

-

What to do if your balance sheet isn’t strong yet

By the end, you’ll understand clearly why lenders want to see balance sheets and how you can make yours lender-ready.

What is a Balance Sheet?

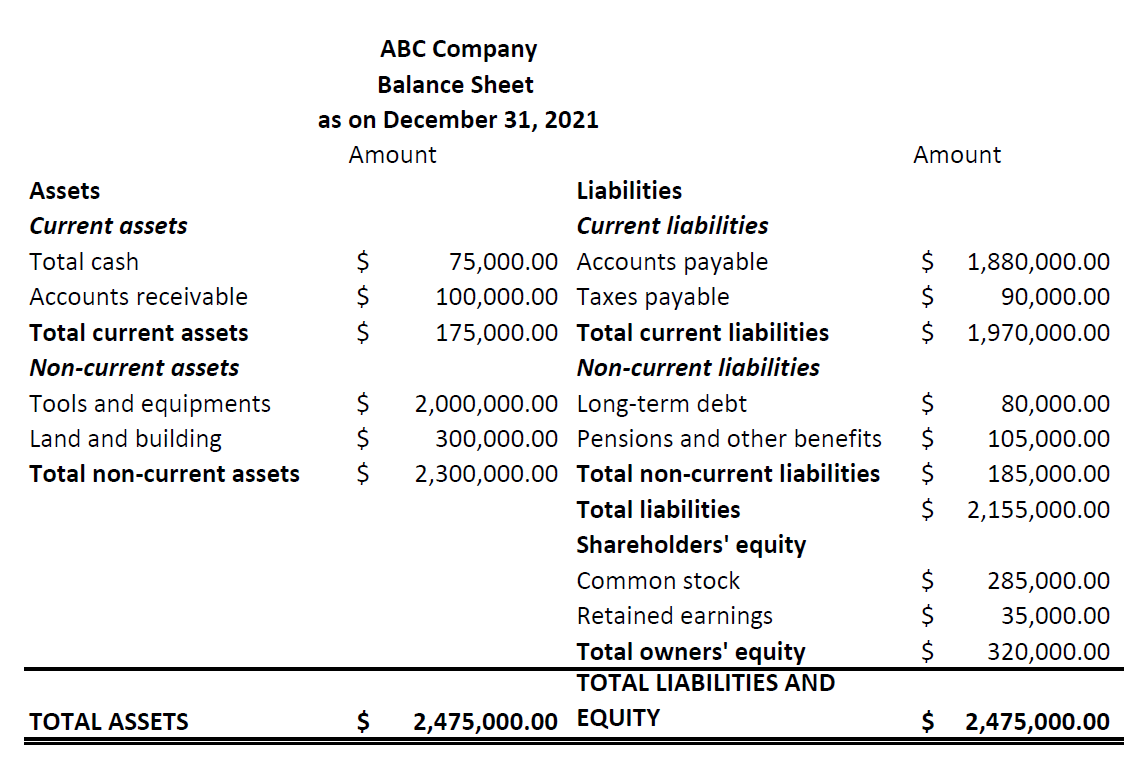

A balance sheet is a financial statement that captures a snapshot of a business’s assets, liabilities and equity at a specific point in time.

Here’s what to know:

-

Assets: things the business owns (cash, inventory, equipment, property)

-

Liabilities: what the business owes (loans, accounts payable, tax obligations)

-

Equity (or net worth): the difference between assets and liabilities; essentially the owner’s stake.

-

The basic equation: Assets = Liabilities + Equity.

Unlike an income statement (which covers a period of time), the balance sheet shows your financial position at a specific moment.

Why Lenders Want to See Balance Sheets

Lenders use the balance sheet because it gives them insight into your business’s financial health and its ability to repay a loan. Here’s why it matters:

1. Assessing Liquidity & Short-Term Risk

Lenders want to know whether you have enough liquid assets (cash or easily converted assets) to cover short-term obligations. If a business has many short-term liabilities but few assets to cover them, the risk of default is higher.

2. Evaluating Solvency & Long-Term Risk

The structure of your assets versus liabilities reveals how much debt you carry and whether you’re over-leveraged. A strong balance sheet with more assets than liabilities suggests higher resilience.

3. Understanding Collateral & Capital Structure

If the business has valuable assets (equipment, property) that can serve as collateral, lenders feel more secure. They also look at your equity stake (capital) to see how much risk you bear.

4. Seeing Financial Trends & Signal of Management Quality

Lenders aren’t just looking at a single balance sheet—they compare multiple periods to spot trends (improving or deteriorating). A consistently healthy balance sheet signals good management.

5. Fulfilling Regulatory & Internal Policy Requirements

For many lenders, reviewing a balance sheet is part of standard underwriting. It helps them comply with risk management policies and external regulatory expectations.

What Lenders Look For in the Balance Sheet

When lenders examine your balance sheet, they focus on certain metrics and ratios. Understanding these helps you position your balance sheet more favourably.

Key Ratios & Metrics

-

Current Ratio = Current Assets / Current Liabilities. Measures short-term liquidity.

-

Quick Ratio (or Acid Test) = (Cash + Accounts Receivable) / Current Liabilities. More conservative than current ratio.

-

Working Capital = Current Assets – Current Liabilities. Indicates buffer for short-term needs.

-

Debt to Equity Ratio = Total Liabilities / Equity. Lower ratio means less reliance on debt financing.

-

Asset Coverage: Are your assets easily convertible and can they cover liabilities? agcredit.net

Lenders also qualitatively review:

-

What types of assets you hold (cash vs inventory vs illiquid equipment)

-

Whether liabilities include large off-balance sheet obligations

-

The age of assets and whether there is depreciation or obsolescence risk

-

Trends: Are assets growing? Is debt increasing? Is equity shrinking?

How to prepare your balance sheet for a lender in 6 steps:

-

List all current assets (cash, receivables)

-

List all current liabilities (payables, short-term debt)

-

List long-term assets and long-term liabilities

-

Calculate equity (Assets – Liabilities)

-

Compute current ratio and debt-to-equity ratio

-

Verify and document each number with supporting records

This concise list can help lenders clearly see your financial position.

How to Make Your Balance Sheet Lender-Ready

You want to present a balance sheet that gives lenders confidence. Here are actionable steps:

A. Maintain accuracy and clarity

-

Ensure all assets and liabilities are properly classified.

-

Use consistent reporting periods (e.g., year-end vs month-end) to allow trend comparison.

-

Provide supporting documentation: bank statements, equipment invoices, receivable aging, etc.

B. Strengthen key ratios where you can

-

Increase liquidity: maintain sufficient cash or easily accessible assets.

-

Reduce liabilities: pay down debt where possible before seeking new financing.

-

Improve asset quality: avoid over-inflated inventory or outdated equipment on the books.

-

Increase equity: invest your own funds (shows you have skin in the game).

C. Explain unusual items

-

If you have large assets that aren’t easily liquid (real estate, machinery), note that and explain the business logic.

-

If you have seasonal liabilities, document expected cyclical patterns so lenders can understand.

D. Provide trend context

-

Include 2–3 years of balance sheets (if available) so lender can spot improvement or warning signs.

-

Tie balance sheet figures to your business plan or projections to show how you’ll manage future debt.

E. Prepare narrative/cover summary

-

Alongside the balance sheet attach a one-page summary: highlight major assets, liabilities, and significant changes.

-

Explain how the loan you’re seeking will affect the balance sheet (e.g., new equipment will increase assets and revenue).

Why a Weak Balance Sheet Can Hurt Loan Approval

If your balance sheet isn’t strong, you may face higher interest rates, smaller loan amounts, stricter covenants, or outright denial. Reasons why a weak balance sheet is risky:

-

Low liquidity means you might struggle to meet repayments if revenue drops.

-

High leverage (too much debt) increases default risk.

-

Assets that aren’t credible or liquid reduce collateral value.

-

Declining equity indicates business deterioration or lack of reinvestment.

-

No trend reference or irregularities raise red flags for underwriters.

Lenders must protect themselves. A weak balance sheet increases their risk of loss — so they either compensate (higher rate, more collateral) or refuse.

Common Questions from Borrowers

Do lenders ask only for the balance sheet?

No. They also typically ask for: income statements (profit & loss), cash-flow statements, business plan, tax returns, collateral documentation and sometimes personal financial statements.

What if my business is new and I have no prior balance sheet?

If you’re a startup, you’ll need projected financials and an opening balance sheet along with personal financial statements or personal balance sheet backup. Focus on building a clear asset/liability view and show your plan for growth.

Can I submit a “pro forma” or projected balance sheet?

Projections are useful, but you must also provide actual historical data. Lenders trust historical data more than optimistic forecasts. If you submit pro forma data, clearly label it and tie it to realistic assumptions.

How often will the lender review my balance sheet?

It depends on the loan type and covenants, but lenders often request updated financial statements (including balance sheets) annually or quarterly during the life of the loan.

Summary

In short: why lenders want to see balance sheets is because these financial statements give lenders a clear, factual picture of your business’s assets, liabilities, liquidity, solvency, and overall financial health. A strong balance sheet reduces risk for the lender and increases your chances of favorable loan terms.

If you’re seeking a business loan, take time now to prepare a clean, accurate, and well-explained balance sheet. Improve liquidity, reduce debt where possible, and present clear documentation. Doing this will position you as a credible borrower.