SBA Loans vs. Personal Loans for Business: Which Is Smarter?

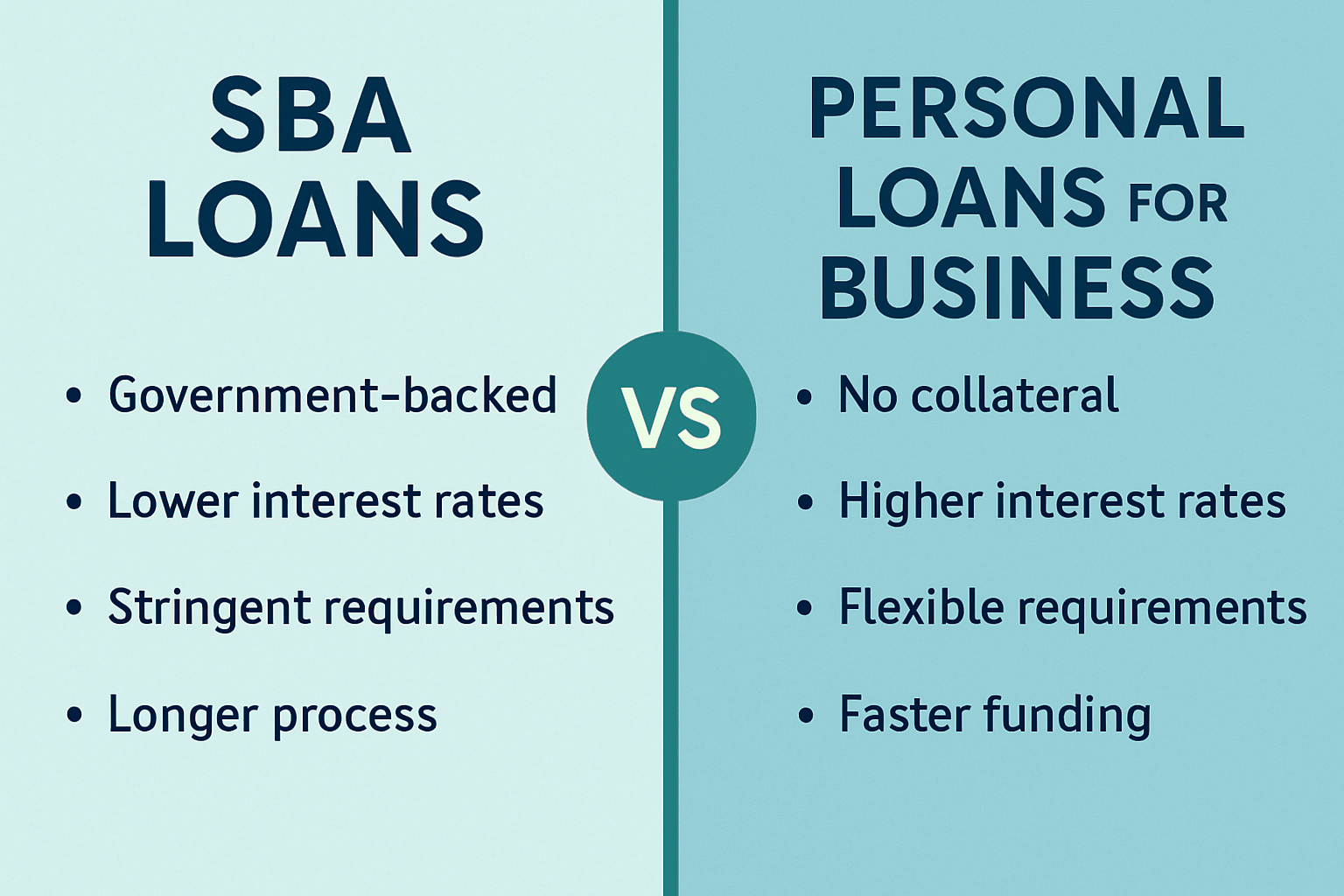

When you’re ready to fund your small business, two common options often come up: SBA loans and personal loans. Both can provide the capital you need to start or grow your business — but they differ in qualification requirements, costs, and long-term impact.

Choosing the smarter option depends on your goals, credit profile, and how quickly you need funding. This guide breaks down the key differences between SBA loans vs. personal loans for business, helping you decide which is right for you in 2025.

What Is an SBA Loan?

An SBA loan is a small business loan partially guaranteed by the U.S. Small Business Administration (SBA). The guarantee reduces the lender’s risk, allowing banks and approved financial institutions to offer lower interest rates and longer repayment terms than conventional loans.

Common SBA loan types include:

-

SBA 7(a) Loan: General-purpose loan up to $5 million (working capital, expansion, equipment, etc.)

-

SBA 504 Loan: For purchasing real estate, heavy equipment, or fixed assets

-

SBA Microloan: Up to $50,000 for startups and small projects

Key benefits:

-

Lower interest rates (usually 8%–12% in 2025)

-

Long repayment terms (up to 10–25 years)

-

High loan limits (up to $5 million)

-

Flexible use of funds

Drawbacks:

-

Requires strong credit and financial history

-

Extensive documentation and longer approval time

-

May require collateral and personal guarantees

Best for: Established small businesses looking for affordable, long-term financing.

What Is a Personal Loan for Business?

A personal loan for business is a traditional unsecured loan issued to an individual rather than a business entity. You can use the funds for almost any purpose, including starting or expanding a business.

Key benefits:

-

Fast approval — often within 24–48 hours

-

Minimal documentation required

-

Available to new entrepreneurs without business credit history

-

No need to have a registered business entity

Drawbacks:

-

Higher interest rates (typically 10%–20% or more)

-

Lower borrowing limits (usually $5,000–$100,000)

-

Shorter repayment terms (1–7 years)

-

Puts your personal credit at risk if the business fails

Best for: Startups, solopreneurs, or side hustles that need quick, smaller amounts of capital.

SBA Loans vs. Personal Loans: Side-by-Side Comparison

| Feature | SBA Loan | Personal Loan for Business |

|---|---|---|

| Approval Time | 2–8 weeks | 1–3 days |

| Loan Amount | Up to $5 million | Up to $100,000 |

| Interest Rate (2025 avg.) | 8%–12% | 10%–20%+ |

| Repayment Term | 5–25 years | 1–7 years |

| Collateral Required | Often required | Usually not |

| Credit Needed | 680+ business/personal | 650+ personal |

| Use of Funds | Business-only | Any purpose |

| Best For | Established businesses | New or small ventures needing fast cash |

When an SBA Loan Is Smarter

SBA loans are the smarter long-term choice when you’re ready to build sustainable business credit and expand operations strategically.

You should choose an SBA loan if you:

-

Want low monthly payments with long repayment terms

-

Have strong personal and business credit

-

Need to finance large purchases or expansion

-

Want to separate business and personal finances

-

Plan to grow over several years

SBA loans not only save money on interest but also help build credibility — lenders see repayment as proof your business is stable and trustworthy.

When a Personal Loan Might Be Better

A personal loan can make sense when your business is just starting and you don’t yet qualify for an SBA or business loan.

You might choose a personal loan if you:

-

Need funding fast for a time-sensitive opportunity

-

Are starting a business without established credit or revenue

-

Only need a small amount of capital

-

Don’t want to go through the SBA’s lengthy application process

However, it’s important to remember: your personal finances are on the line. If your business struggles, late payments will affect your credit score and debt-to-income ratio.

How to Decide: SBA Loan vs. Personal Loan

-

Evaluate how much funding you need

-

Check your credit score and financial history

-

Compare repayment terms and total costs

-

Consider how quickly you need funds

-

Decide if you want to separate personal and business debt

Example: Comparing Costs

Let’s say you need $50,000 for expansion.

-

SBA 7(a) Loan: 10-year term at 9% interest → Monthly payment ≈ $633, total interest ≈ $25,960

-

Personal Loan: 5-year term at 14% interest → Monthly payment ≈ $1,162, total interest ≈ $19,720

Even though the total interest is lower on the shorter personal loan, the monthly payment is nearly double, which can strain cash flow. SBA loans offer breathing room for long-term growth.

Tips for Choosing the Right Loan

-

Plan for long-term goals: If this funding is part of a multi-year growth plan, SBA wins.

-

Check your credit: SBA lenders prefer credit scores of 680+.

-

Avoid overborrowing: Only borrow what your business can repay comfortably.

-

Compare lenders: Both SBA and personal loans vary widely in rates and fees.

-

Separate business finances: Use business loans to protect your personal credit over time.

Common Mistakes to Avoid

-

❌ Using personal loans for high-risk investments: Your credit and assets could be at risk.

-

❌ Ignoring cash flow: Even low-interest loans can hurt if revenue dips.

-

❌ Not comparing total costs: Consider fees, insurance, and early payment penalties.

-

❌ Skipping business credit building: Relying on personal loans long-term limits growth potential.

Conclusion: Which Loan Is Smarter for You?

If you’re an established business with solid credit and steady revenue, an SBA loan is almost always the smarter choice — offering better rates, higher limits, and long-term benefits for your business credit.

If you’re a new entrepreneur needing fast, smaller-scale funding, a personal loan can help you get started — just be cautious about mixing business and personal finances.

In short: personal loans can launch your idea — but SBA loans can help you scale it.