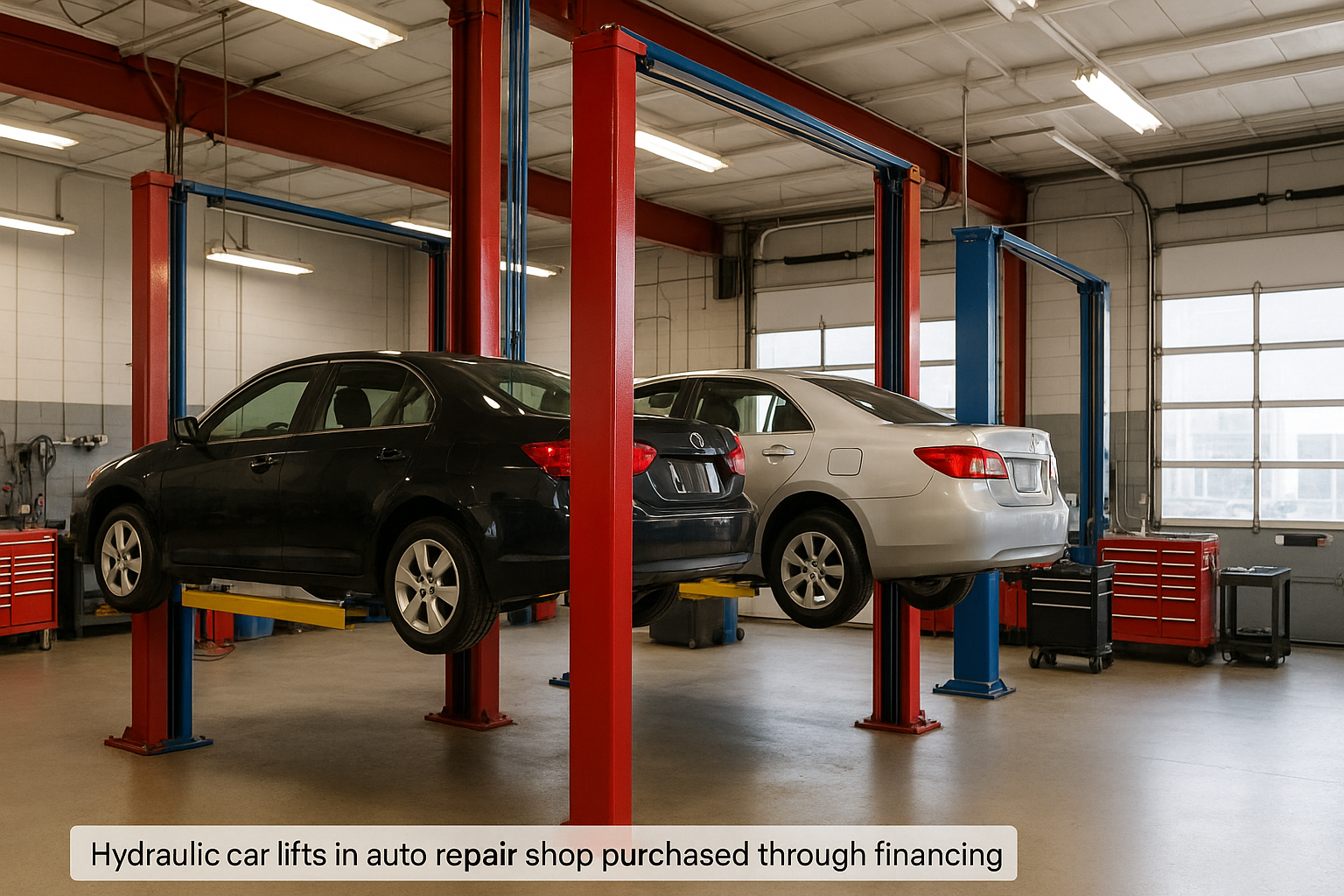

Equipment Loans for Lifts, Compressors, and Diagnostic Tools

Opening or upgrading an auto repair shop requires specialized, high-cost equipment. Equipment loans for lifts, compressors, and diagnostic tools can help you get the gear you need without draining your cash reserves. Whether you’re starting fresh or expanding, the right financing solution ensures your shop operates efficiently from day one.

Why These Tools Are Critical for Your Shop

Lifts, compressors, and diagnostic tools form the backbone of any professional garage. They directly impact your ability to:

-

Increase service capacity

-

Improve repair accuracy

-

Reduce turnaround time for customers

-

Expand the types of services offered

Without them, your shop’s productivity and revenue potential take a serious hit.

Common Equipment Loan Options

1. Traditional Bank Loans

-

Competitive rates for borrowers with strong credit.

-

May require collateral and a detailed business plan.

2. SBA Loans

-

Government-backed programs like the SBA 7(a) can finance multiple pieces of equipment in one package.

-

Longer terms and lower down payments.

3. Dedicated Equipment Financing

-

Secured by the equipment itself.

-

Fixed monthly payments and flexible terms (2–7 years).

4. Vendor Financing

-

Offered directly by manufacturers or distributors.

-

May include promotional low-interest or deferred payment plans.

Featured Snippet: Quick Steps to Get an Equipment Loan

(Optimized for Google snippet position)

-

List needed equipment and costs.

-

Choose a financing type.

-

Gather financial documents.

-

Apply to multiple lenders.

-

Compare offers and sign.

Sample Cost Estimates

| Equipment | Estimated Price |

|---|---|

| 2-Post Hydraulic Lift | $4,000 – $8,000 |

| Air Compressor (80–120 gal) | $1,200 – $3,500 |

| Professional Diagnostic Scanner | $3,000 – $8,000 |

Tips for Securing the Best Loan Terms

-

Keep credit score above 680 for better rates.

-

Negotiate down payment requirements.

-

Consider bundling equipment purchases for a larger loan with one fixed rate.

-

Always compare offers from at least three lenders.

Benefits of Financing Over Paying Cash

-

Preserve working capital for daily expenses.

-

Upgrade sooner without waiting to save.

-

Potential tax benefits through Section 179 deductions.

-

Build business credit history for future expansions.

Final Thoughts

The right equipment loan can transform your shop’s capabilities overnight. By financing lifts, compressors, and diagnostic tools, you position your business for higher productivity, better customer service, and long-term growth.

Call to Action

Ready to upgrade your shop’s equipment? Compare equipment loan options today and find the financing that fits your budget and goals.