Differences between SBA 7(a) and SBA 504 loans

If you’re exploring small business financing through the Small Business Administration (SBA), two programs dominate the conversation: the SBA 7(a) and SBA 504 loans.

Both offer low interest rates, long repayment terms, and flexible funding — but they serve different purposes. Knowing their key distinctions can help you choose the right one for your business goals.

This guide breaks down the differences between SBA 7(a) and SBA 504 loans — including eligibility, rates, repayment, and what each loan is best for.

What Are SBA Loans?

SBA loans are not issued directly by the federal government. Instead, the U.S. Small Business Administration guarantees a portion of the loan, reducing risk for lenders and making it easier for small businesses to qualify.

Both the SBA 7(a) and SBA 504 programs are designed to promote growth — but they focus on different types of financing needs.

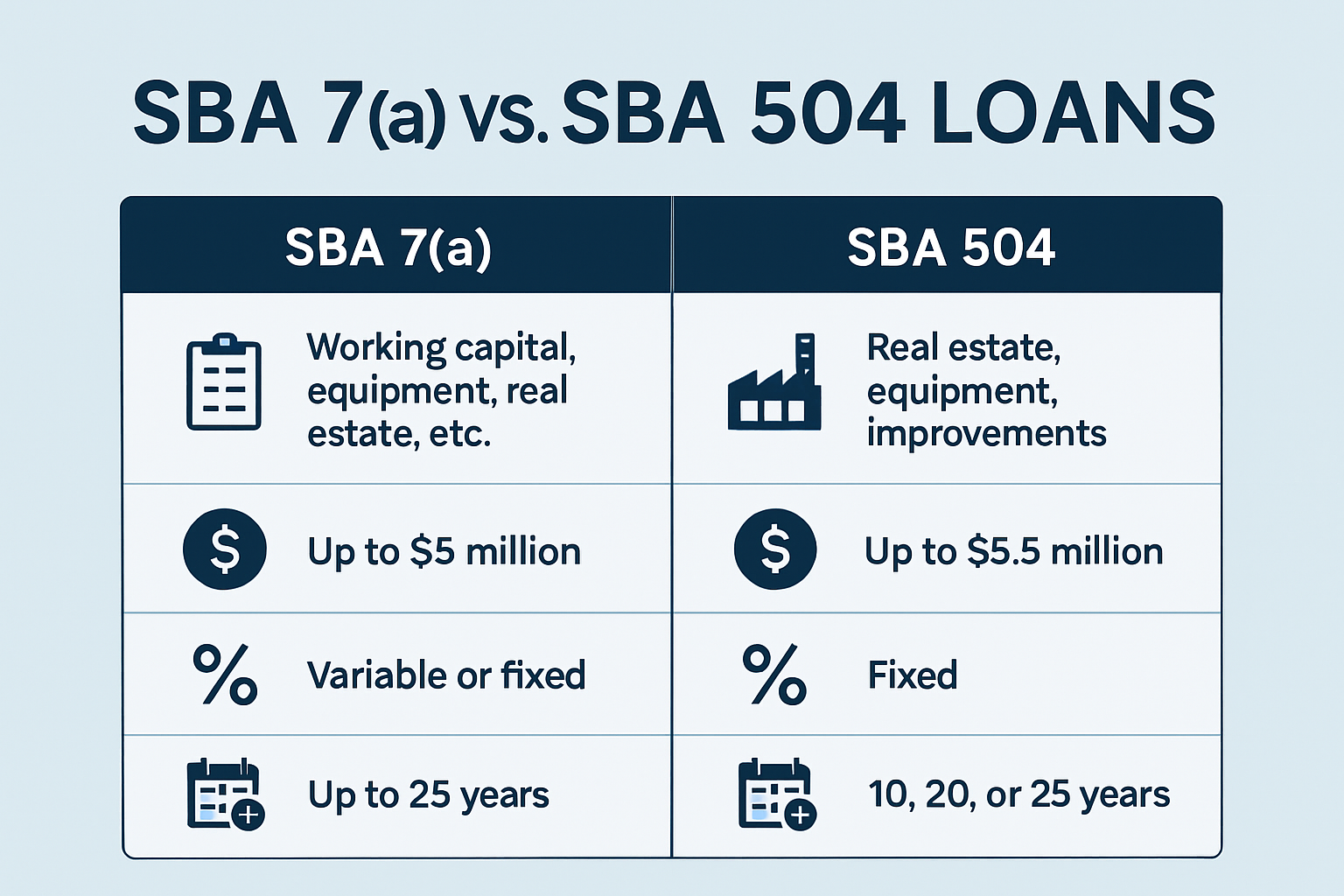

Overview: SBA 7(a) vs. SBA 504 at a Glance

| Feature | SBA 7(a) Loan | SBA 504 Loan |

|---|---|---|

| Purpose | General use (working capital, equipment, debt refinance, real estate) | Fixed assets (commercial real estate, heavy equipment) |

| Loan Amounts | Up to $5 million | Up to $5.5 million (CDC portion) |

| Loan Structure | One loan from a bank or SBA lender | Two-part loan: 50% bank + 40% CDC + 10% borrower |

| Collateral | Required if loan > $50,000 | The asset being financed serves as collateral |

| Interest Rate | Variable or fixed (based on Prime + spread) | Fixed (based on Treasury rates) |

| Terms | Up to 10 years for working capital; 25 years for real estate | 10, 20, or 25 years |

| Use of Funds | Working capital, inventory, refinancing, real estate | Land, buildings, renovations, equipment |

| Down Payment | Typically 10%–20% | Usually 10% (up to 20% for special-use properties) |

| Lender Type | Bank or SBA-approved lender | Bank + Certified Development Company (CDC) |

| Approval Time | 2–6 weeks | 4–8 weeks |

| Guarantee Fee | Yes (based on loan size) | No ongoing guarantee fee for CDC portion |

SBA 7(a) Loan: Flexible Financing for General Business Needs

The SBA 7(a) program is the most popular SBA loan, accounting for roughly 70% of all SBA lending activity.

Best for:

-

Working capital and daily operations

-

Business expansion or acquisition

-

Equipment or inventory purchases

-

Refinancing higher-interest business debt

-

Real estate (if combined with other uses)

Key advantages:

-

Can be used for nearly any legitimate business purpose

-

Lower down payments than traditional loans

-

Can include short- and long-term financing in one package

Interest rates (2025 estimate):

-

Variable: Prime + 2.25% to 4.75%

-

Fixed: 9%–11% depending on loan term and credit

Example:

A retail business borrows $350,000 to purchase new inventory and refinance old debt. They choose a 10-year SBA 7(a) loan with a variable rate tied to the Prime Rate.

SBA 504 Loan: Fixed-Asset Financing for Growth

The SBA 504 loan is built for major, long-term investments in fixed assets like commercial property or heavy equipment.

Best for:

-

Buying or constructing commercial real estate

-

Expanding or renovating facilities

-

Purchasing long-term equipment or machinery

Loan structure:

-

50% funded by a traditional lender (bank or credit union)

-

40% funded by a Certified Development Company (CDC) (backed by SBA)

-

10% down payment from the borrower

Interest rates (2025 estimate):

-

Fixed: Around 6%–7% (based on U.S. Treasury bond yields)

-

Locked in for the entire term — no surprises or rate hikes

Example:

A manufacturing company wants to buy a $1 million warehouse.

-

$500,000 from a bank

-

$400,000 from a CDC (SBA-guaranteed)

-

$100,000 from the business as down payment

Key Differences Between SBA 7(a) and 504 Loans

Let’s break down the most important distinctions:

1. Purpose of Funds

-

SBA 7(a): Broad usage — working capital, inventory, refinancing, business purchase, or real estate.

-

SBA 504: Fixed-asset purchases — real estate, machinery, and construction only.

2. Loan Structure

-

7(a): One lender handles the full loan (with SBA guarantee).

-

504: Two lenders — a CDC and a bank — share the funding.

3. Interest Rates

-

7(a): Typically variable, can fluctuate with the market.

-

504: Fixed, based on long-term Treasury yields.

4. Down Payment

-

7(a): 10%–20% (depends on risk and use).

-

504: 10% standard, but may increase for startups or special-use buildings.

5. Collateral

-

7(a): Required if loan exceeds $50,000.

-

504: The purchased property or equipment serves as collateral.

6. Use Restrictions

-

7(a): Can be used for nearly all business expenses.

-

504: Limited to tangible assets that promote long-term growth.

7. Loan Terms

-

7(a): Up to 10 years (working capital) or 25 years (real estate).

-

504: 10, 20, or 25 years — ideal for fixed investments.

8. Funding Speed

-

7(a): Generally faster; great for working capital needs.

-

504: Slightly longer due to dual-lender approval process.

9. Fees and Costs

-

7(a): SBA guarantee and packaging fees (up to 3.75%).

-

504: Lower ongoing fees; CDC portion has minimal servicing costs.

10. Who It’s Best For

| SBA 7(a) | SBA 504 |

|---|---|

| Businesses needing flexible use of funds | Companies buying property or equipment |

| Entrepreneurs with limited collateral | Established firms making fixed investments |

| Those refinancing or consolidating debt | Businesses expanding physical facilities |

| Companies needing working capital | Owners seeking fixed-rate, long-term stability |

How to Decide Which SBA Loan Fits Your Business

Ask yourself these questions:

✅ Do I need short-term or flexible funding?

→ Choose the SBA 7(a).

✅ Am I buying property, building, or machinery?

→ Go with the SBA 504.

✅ Do I prefer fixed or variable interest?

→ Fixed: 504 loan.

→ Variable: 7(a) loan.

✅ Am I a newer business?

→ The 7(a) program is often more accessible.

✅ Do I want smaller down payments?

→ The 504 typically requires just 10%.

SBA 7(a) vs. 504 Loans (Featured Snippet Section)

-

7(a): Flexible, single-lender loan for working capital, expansion, or refinancing

-

504: Fixed-rate, dual-lender loan for real estate and long-term assets

How to Qualify for Either Program

-

Be a for-profit U.S. business

-

Meet SBA size standards

-

Have good personal and business credit (ideally 650+)

-

Demonstrate ability to repay through cash flow

-

Show a clear, legitimate use of funds

-

Provide a down payment (usually 10%)

Pro Tip: Strong financials and a well-prepared loan package — including business tax returns, P&L statements, and projections — increase your approval odds for both loan types.

Final Thoughts: Choosing Between SBA 7(a) and 504

Both SBA 7(a) and 504 loans are powerful funding tools for small businesses, but they serve different purposes.

-

Choose SBA 7(a) for flexibility and working capital.

-

Choose SBA 504 for fixed, long-term investments in real estate or equipment.

If your business is growing and you’re ready to expand operations, the right SBA program can provide affordable, long-term financing to help you scale with confidence.