How to Choose the Right Business Loan for Your Company: A Comprehensive Guide Debt factoring is beco...

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

How to Choose the Right Business Loan for Your Company: A Comprehensive Guide Debt factoring is beco...

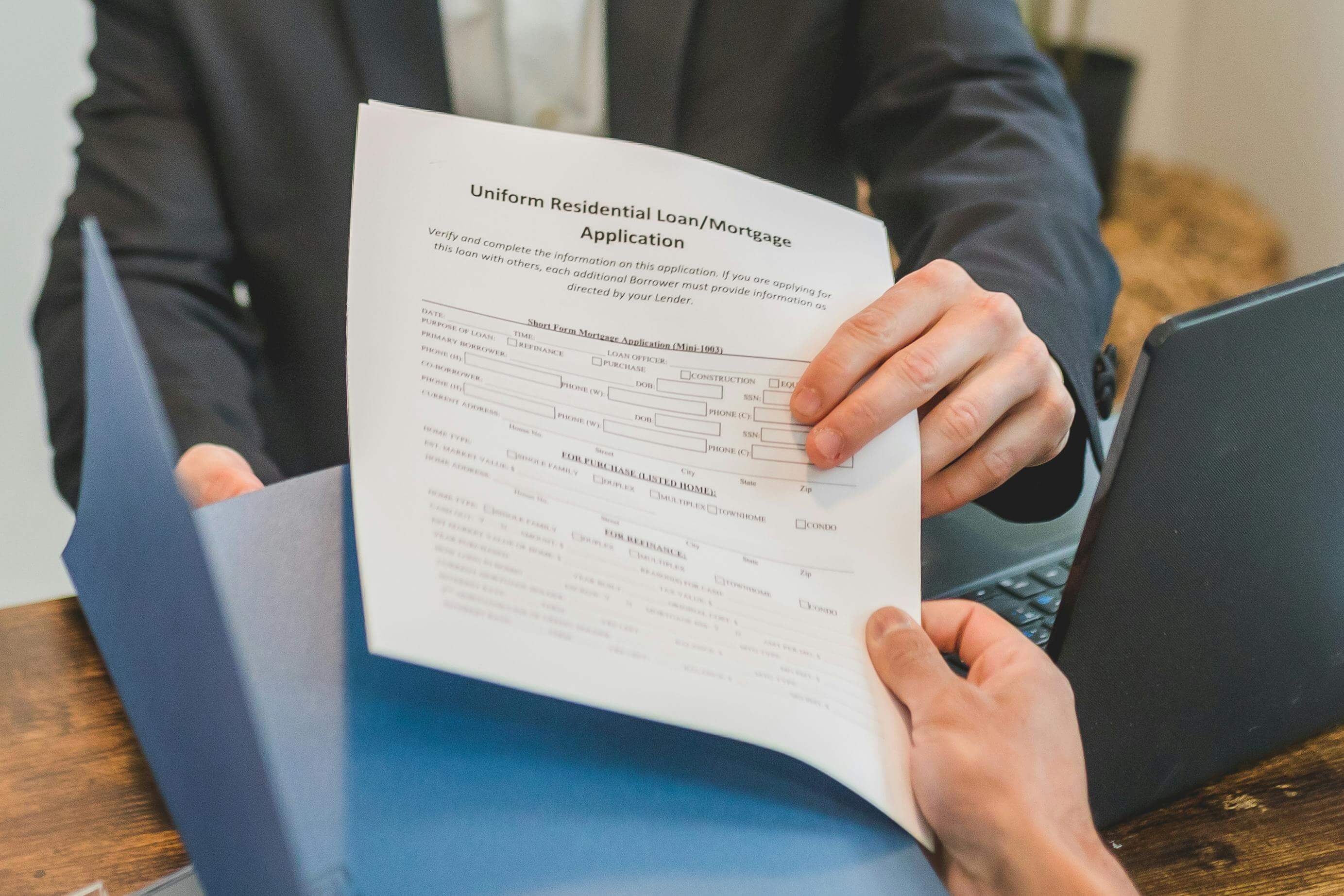

Why Lenders Want to See Business Bank Statements Running a business often requires outside funding, ...

How Co-Signers Work in Business Lending: A Complete Guide for Small Business Owners Understanding ho...

What Is Cross-Collateralization in Loans? A Complete Guide for Borrowers Cross-collateralization is ...

What Is a Balloon Mortgage in Commercial Lending? If you’re exploring commercial real estate financi...

The 5 Cs of Credit Lenders Use: A Complete Guide to How Borrowers Are Evaluated Understanding the 5 ...

How to Calculate Your Debt-to-Income Ratio: A Complete Guide to Understanding Your Financial Health ...

Are Zero-Down Business Loans Possible? (Full Guide for 2025) Can you really get a business loan with...

Why Alternative Lenders Offer Higher Rates: A Complete Guide for Small Business Owners Alternative l...

How Inflation Impacts Long-Term Business Loans: A Complete Guide for 2025 Inflation affects virtuall...

How to Predict Future Loan Payments If Rates Rise (2025 Guide) Interest rates are unpredictable — an...

Fixed-Rate vs Floating-Rate Loans for Small Businesses: Which Is Best for You? Choosing the right ty...

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.