Extermination and pest control companies are essential for maintaining healthy living and working...

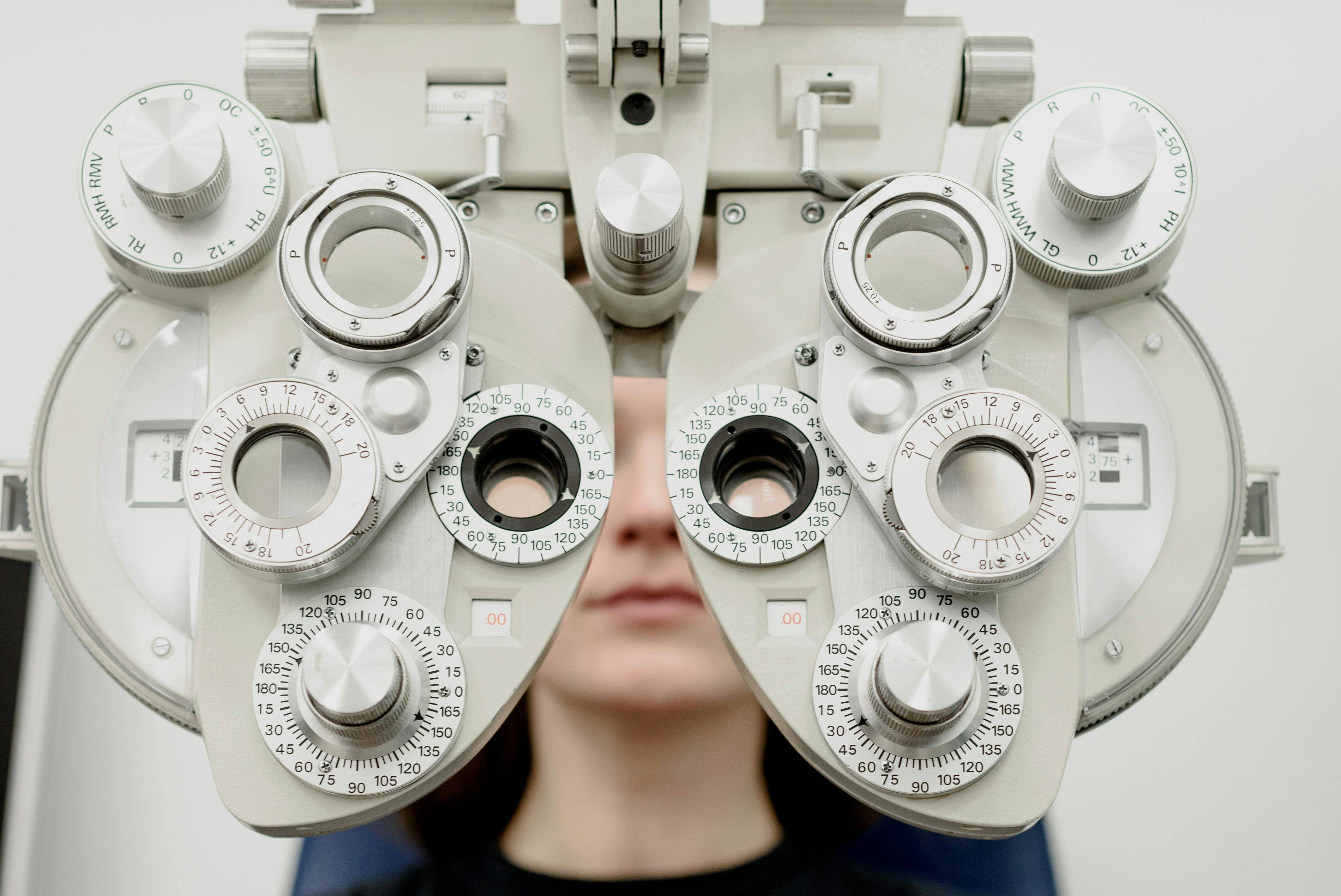

Optometry companies play a crucial role in providing eye care services, including vision tests, eye exams, and prescribing corrective lenses. Running an optometry business requires substantial investment in state-of-the-art equipment, technology, staff training, marketing, and facility maintenance. Securing the right business loans can help optometry companies expand their services, upgrade equipment, and ensure financial stability. This guide explores the best business loans for optometry companies and how Crestmont Capital can help secure the financing needed to achieve your business goals.

Why Optometry Companies Need Business Loans

Operating an optometry company involves significant financial requirements. Here are some key reasons why securing business loans is crucial for your business:

- Purchasing Advanced Equipment

Optometry businesses need advanced diagnostic and treatment equipment, such as digital retinal cameras, optical coherence tomography (OCT) machines, and automated refraction systems. Business loans can help finance these expensive purchases, ensuring your practice remains competitive and provides high-quality care.

- Facility Upgrades and Expansion

Modern and well-maintained facilities are essential for delivering excellent patient care. Business loans can fund renovations, expansions, and upgrades to your clinic, ensuring a comfortable and efficient environment for patients and staff.

- Technology Integration

Implementing advanced technology, such as electronic health records (EHR) systems, practice management software, and telemedicine solutions, can enhance operational efficiency and patient care. Business loans can cover the costs of acquiring and integrating these technologies.

- Staffing and Training

Attracting and retaining skilled optometrists, technicians, and support staff is crucial for maintaining high service standards. Business loans can provide the funds needed for competitive salaries, benefits, and ongoing professional development for your employees.

- Marketing and Patient Acquisition

Effective marketing strategies are essential for attracting new patients and retaining existing ones. Business loans can fund marketing campaigns, community outreach programs, and partnerships with local businesses and organizations to increase awareness of your services.

- Managing Cash Flow

Managing cash flow is critical in the optometry industry, especially when dealing with insurance reimbursements and payment delays. Business loans can provide working capital to ensure smooth operations and financial stability.

Top Business Loan Options for Optometry Companies

Various types of business loans and funding options can meet the diverse needs of optometry companies. Here are some top solutions:

- Equipment Financing

If you need to purchase new diagnostic or treatment equipment, equipment financing can provide the funds required. The equipment itself often serves as collateral, making these loans easier to obtain and usually offering lower interest rates.

- Term Loans

Term loans provide a lump sum of capital repaid over a fixed period with set interest rates. They are ideal for significant investments such as facility upgrades, technology implementation, or purchasing high-cost equipment.

- Business Lines of Credit

A business line of credit offers flexible access to funds that you can draw upon as needed. This option is excellent for managing cash flow, covering operational expenses, and addressing unexpected costs, as you only pay interest on the amount you borrow.

- SBA Loans

Small Business Administration (SBA) loans are government-backed loans that offer favorable terms and lower interest rates. These loans can be an excellent option for optometry companies seeking long-term financing with attractive conditions.

- Working Capital Loans

Working capital loans are designed to cover day-to-day operational expenses. These loans are ideal for managing short-term financial needs, such as payroll, utilities, and supplies, ensuring your business runs smoothly without financial interruptions.

- Invoice Financing

Invoice financing, or factoring, allows you to borrow against your outstanding invoices. This type of loan can provide immediate cash flow while waiting for insurance reimbursements or patient payments, helping you manage your finances more effectively.

- Merchant Cash Advances

A merchant cash advance provides a lump sum of capital in exchange for a percentage of your future credit card sales. This option is beneficial for businesses with strong credit card sales and can provide quick access to funds for immediate needs.

- Real Estate Loans

If you need to purchase or renovate your clinic, real estate loans can provide the necessary financing. These loans typically offer long-term repayment plans and competitive interest rates, making them a good choice for significant property investments.

How Crestmont Capital Can Help

Securing the right financing for your optometry company is crucial for achieving growth and operational excellence. Crestmont Capital specializes in providing tailored financing solutions to meet the unique needs of healthcare businesses. Here’s how Crestmont Capital can support your business:

- Customized Loan Options

Crestmont Capital offers a range of loan products designed to meet your specific financing needs. Whether you need short-term funding for immediate expenses or long-term financing for strategic investments, we have you covered.

- Fast and Efficient Application Process

In the fast-paced healthcare industry, timing is critical. Crestmont Capital’s streamlined application process ensures quick decisions and fast access to funds, allowing you to seize opportunities without delay.

- Competitive Rates and Flexible Terms

We provide competitive interest rates and flexible repayment terms tailored to your financial situation. Our transparent fee structure ensures you understand all costs upfront, so there are no surprises.

- Dedicated Customer Service

At Crestmont Capital, we pride ourselves on delivering personalized service. Our experienced loan specialists take the time to understand your business objectives and challenges, providing tailored financing solutions that support your vision.

- Ongoing Support

Our commitment to your success doesn’t end with loan approval. We offer ongoing support and financial advice to help you manage your finances effectively and make informed decisions about your business growth.

Conclusion

Optometry companies play a vital role in providing essential eye care services to communities. Achieving success in this industry requires strategic investment in advanced equipment, technology, facilities, staffing, and marketing. Business loans can provide the capital necessary to expand services, improve efficiency, and maintain financial stability. With Crestmont Capital as your trusted financial partner, you can access the funding you need to take your optometry company to the next level. Unlock your full potential today with Crestmont Capital’s innovative financing solutions.